- General

- September 2, 2019

- 12 minutes read

ECB’s Mersch Takes A Jab At Facebook’s Libra

Yves Mersch, Member of the Executive Board of the European Central Bank image: Latvijas Banka on Flickr In a recent…

|

| Yves Mersch, Member of the Executive Board of the European Central Bank

image: Latvijas Banka on Flickr

|

In a recent speech at the ESCB Legal Conference, Yves Mersch, who serves as a member of the Executive Board of the European Central Bank, took quite a jab at Libra, Facebook’s recently unveiled digital currency. During his speech, Mersch outlines concerns on the adoption of Facebook’s digital currency, which is scheduled to launch in the first half of next year. Mersch’s speech focused on three core questions: “First, how does Libra differ from other private currencies and from public money? Second, what legal and regulatory challenges does it pose? And third, in the light of its mandate, what position should a central bank like the ECB [European Central Bank] take towards Libra?”.

Before moving on to touch on the questions, Mersch earlier reminisced of previous controversies Facebook has faced. “…I will today talk about Libra, Facebook’s newly announced private currency. It is scheduled for release in the first half of 2020 by the very same people who had to explain themselves in front of legislators in the United States and the European Union on the threats to our democracies resulting from their handling of personal data on their social media platform.” He said. Mersch’s stand isn’t really startling, for someone known as a critic of the adoption of current digital currencies.

To get fully detailed answers given by Mersch in response to his three aforementioned questions, we suggest you take a look at the full speech. However, we’ve provided a summary of his response, outlined below:

- “First, how does Libra differ from other private currencies and from public money?”

Mersch’s take is that despite the “hype” surrounding Libra, it isn’t really different from other private digital currencies that are already in circulation. Mersch’s may be just right, as the Libra will be issued through a public ledger running on a form of blockchain technology as the case has been with other currencies. Where he sees a potential problem is in its control, terming Libra’s handling method as “cartel-like”.

Mersch is referring to the way Libra will be controlled: by a team of founding members who have put up at least $10 million each into its operations. The members, including Facebook itself, will each get a single vote when decisions are to be made concerning the digital currency, similar to the way it’s done in traditional board settings. The members, which include top tech companies, VC firms and some non-profits, will earn interest on the money put in by Libra users, which will be held in reserve to stabilize the value of the currency.

“When it comes to money, centralisation is only a virtue in the right institutional environment, which is that of a sovereign entity and a central issuance authority. Conglomerates of corporate entities, on the other hand, are only accountable to their shareholders and members. They have privileged access to private data that they can abusively monetise. And they have complete control over the currency distribution network. They can hardly be seen as repositories of public trust or legitimate issuers of instruments with the attributes of “money”.” Mersch said.

|

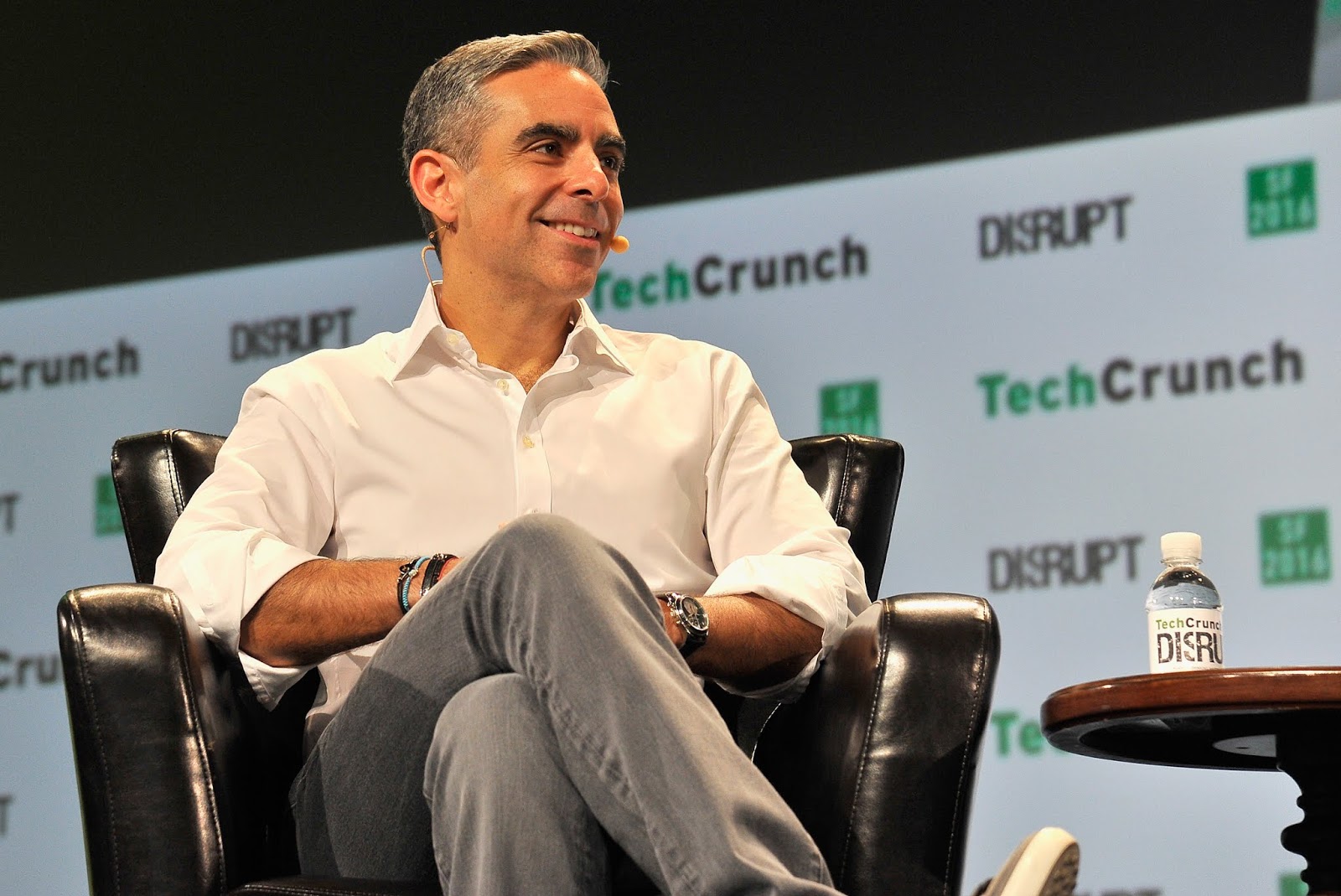

| Facebook’s Libra head, David Marcus. Marcus previously served on the board of Coinbase, and as President at PayPal.

Photo by Steve Jennings/Getty Images for TechCrunch

|

- “Second, what legal and regulatory challenges does it pose?”

Mersch outlined three regulatory challenges [in respect to the EU] concerning Facebook’s Libra: The first being its fundamental legal nature, the second: how the EU and supervisory authorities can be sure of a jurisdiction over the digital currency, and the third: cross-border cooperation and co-ordination, as the Libra is aimed for use across borders. Concerning the first, Mersch weighs if Libra will be treated as e-money, a financial instrument or as a virtual currency, none of which Libra has been formally classified under. He called for regulatory intervention to confirm Libra’s classification under an existing legal and regulatory framework, or create another one for it.

Concerning the second, Mersch is worried that the EU wouldn’t have regulatory control over Libra, given the location of its controlling entities outside the EU. He proposes one way to do that: requiring local custody of a share of Libra’s reserve funds that’s equal to the amount of Libra in circulation in any given EU Member State.

On the third, Mersch says Libra’s cross-border and global nature should attract global regulatory and supervisory response. Some global countries have already begun that, he noted.

|

| Facebook CEO Mark Zuckerberg

image: Anthony Quintano on Flickr

|

- “And third, in the light of its mandate, what position should a central bank like the ECB take towards Libra?”

On this matter, Mersch says the European Central Bank takes a close interest in market innovations that could affect its control over the Euro or shift some of its monetary policy to third parties. Depending on the level of adoption, Mersch says Facebook’s Libra could reduce the ECB’s control over the Euro, affect monetary policies by taking an effect on the liquidity position of eurozone (countries that adopt the euro as their official currency) banks, and “undermine the single currency’s international role”, for instance by reducing its demand.

“In the field of money, history bears testament to two basic truths. The first is that, because money is a public good, money and state sovereignty are inexorably linked. So the notion of stateless money is an aberration with no solid foundation in human experience. The second truth is that money can only inspire trust and fulfill its key socioeconomic functions if it is backed by an independent but accountable public institution which itself enjoys public trust and is not faced with the inevitable conflicts of interest of private institutions.” Mersch said.

“The stance of central banks towards modern forms of money is bound to evolve with time, and central bankers have embraced technological developments in the field of money and will continue to explore helpful new innovations. But the rise of cryptocurrencies and other forms of privately issued instruments that can only fulfil some, but not all, of the functions of money is unlikely to fundamentally upset the two truths I just described.” He said.

In a concluding statement, Mersch took quite a poke, saying “I sincerely hope that the people of Europe will not be tempted to leave behind the safety and soundness of established payment solutions and channels in favour of the beguiling but treacherous promises of Facebook’s siren call.” Mersch’s sentiments echo that of EU Competition Commissioner Margrethe Vestager, who has said that Facebook’s digital currency stimulates antitrust concerns.