- General

- October 22, 2018

- 4 minutes read

Netflix takes on $2 billion bond issue to invest in content production

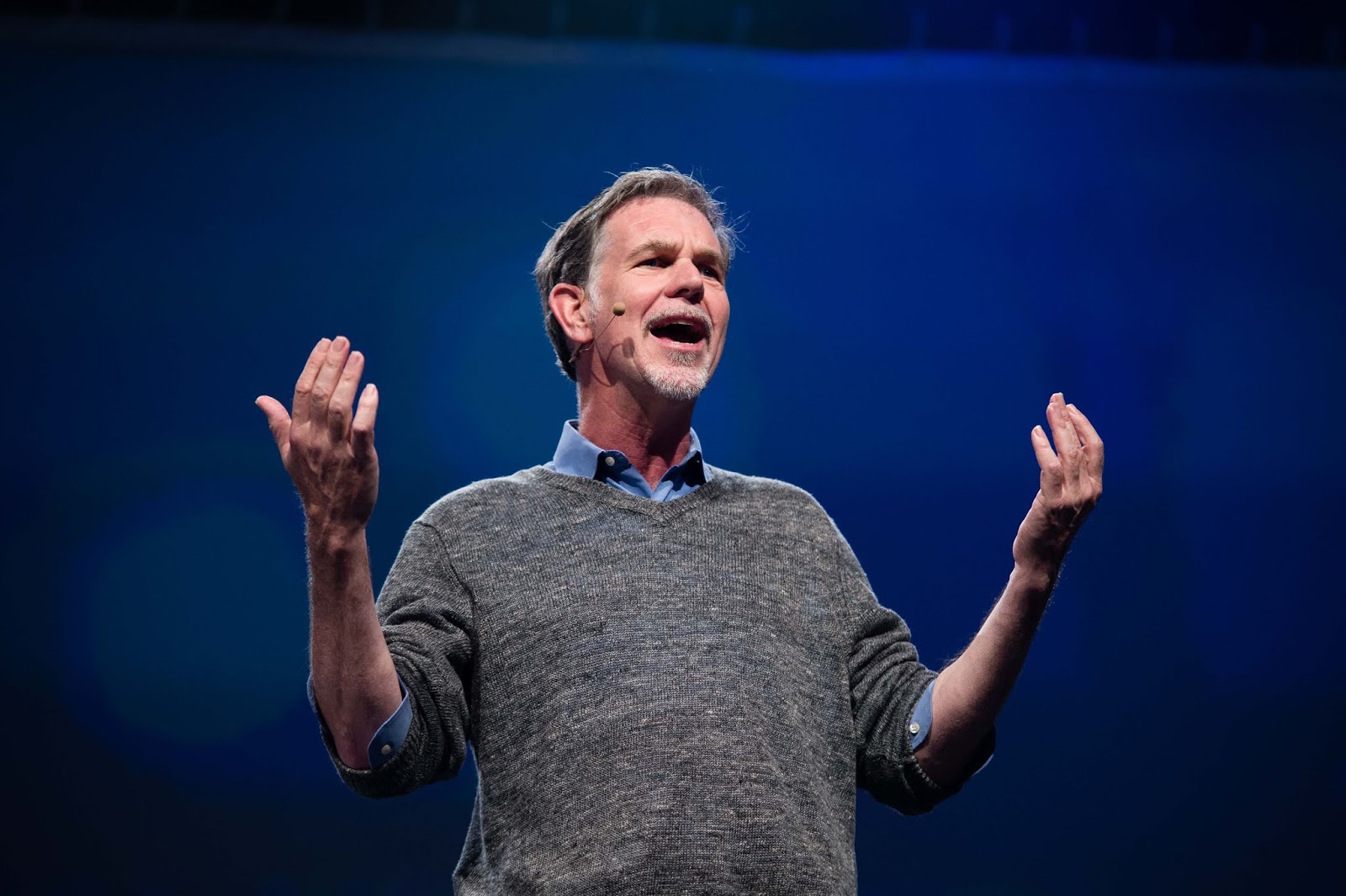

Netflix founder/CEO Reed Hastings image credit : re:publica on Flickr Streaming giant Netflix has now taking to the debt market for…

|

| Netflix founder/CEO Reed Hastings

image credit : re:publica on Flickr

|

Streaming giant Netflix has now taking to the debt market for the second time this year with an announcement of a $2 billion bond issue which will provide the company with additional capital to invest in production of original shows and content acquisition in a bid to fend off growing competition.

As per the company, This move is aimed at funding a broad spread of activities which include paying for new content among other things and led to a drop in bond prices and that of its shares over increasing costs and concerns by investors relating to these hefty costs of future growth.

This April, Netflix sold $1.6 billion in bonds after raising $1.7 billion roughly six month prior which brought its debt total to $8.4 billion. By Q3 end this year, The Los Gatos headquartered company had already spent $6.9 billion TV shows and movies after a planned budget of $8 billion for this year.

|

| Netflix |

With the indicated pace, This year spending might end up being close to $9 billion which signals increasing costs of snapping up more titles and exclusive content to its platform geared at retaining users in a video streaming market where other companies like Amazon, Hulu and others are working towards grabbing more market share.

Netflix released its quarterly results last week which beats estimates thanks to gains in international markets. It added 6.96 million users during the 3rd quarter and is also projecting 9.4 million subscribers to be added during this 4th quarter.