- General

- November 27, 2020

- 6 minutes read

SoftBank Soars To 20-Year High

The share price of the Japanese technology conglomerate SoftBank has risen to a 20-year high of 7,250 Japanese Yen ($69.70) per share,…

The share price of the Japanese technology conglomerate SoftBank has risen to a 20-year high of 7,250 Japanese Yen ($69.70) per share, propelled by a rise of over 70% this year alone. SoftBank is reaping the effects of a surging stock market that’s driven up the value of stakes which it holds in technology companies such as the ride-hailing company Uber.

Notably, SoftBank recently posted a net profit of the equivalent of $18 billion for the first half of this year.

In addition to its current liquid investments in various technology companies, SoftBank is set to clinch sizeable profits from the imminent public listings of two of its portfolio companies, the food delivery company DoorDash and the home flipper Opendoor.

Over the year, SoftBank has spent billions of dollars in share buybacks including $1.35 billion this October alone. The company has a broader plan to buy back as much as $9.6 billion of its stock, a move that’s undoubtedly contributed to its rise.

SoftBank’s rise has cemented its status as one of the highest-valued publicly-traded companies in Japan and the company’s foremost technology conglomerate. From Japan, SoftBank has deployed tens of billions of dollars in capital and gobbled up big stakes and in some cases outright acquisitions of some of the biggest technology companies globally.

SoftBank’s current portfolio include well-known names like Uber, Vir Biotechnology, KE Holdings, Slack, and the chip designer Arm which it’s clinched a deal to sell to Nvidia for a price of $40 billion.

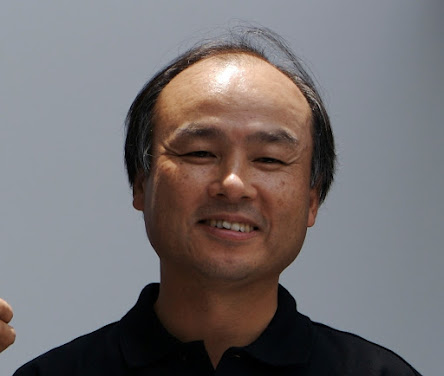

Photo: SoftBank CEO Masayoshi Son by Masaru Kamikura from Japan is licensed under CC BY 2.0

Related;