- General

- May 13, 2020

- 4 minutes read

Uber Proposes $900 Million Bond Sale

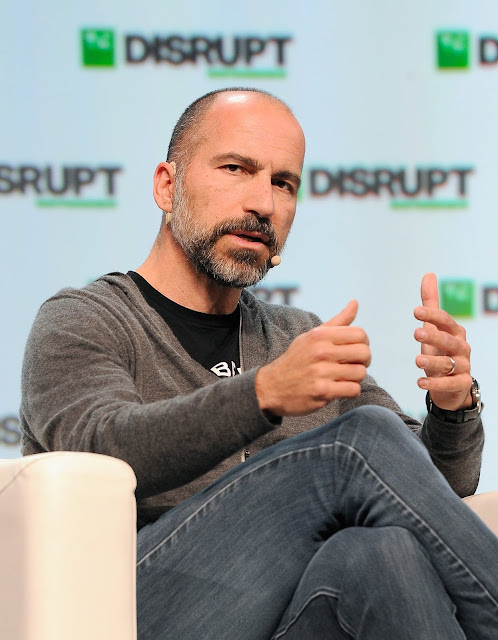

Uber CEO Dara Khosrowshahi. Photo by Steve Jennings/Getty Images for TechCrunch, under Creative Commons license Ride-hailing company Uber early on…

|

| Uber CEO Dara Khosrowshahi. Photo by Steve Jennings/Getty Images for TechCrunch, under Creative Commons license |

Ride-hailing company Uber early on Wednesday announced its intention to issue up to $750 million in bonds that’ll be due by 2025. A later report from Bloomberg said that the size of the bond offering had been boosted to $900 million, notably on the heels of reports that Uber is looking to acquire Grubhub, one of its biggest food delivery competitors. Uber says it intends to put the bonds towards general corporate purposes, which may very well include potential acquisitions. It’s, however, unclear if Uber is running the bond sale to facilitate a possible Grubhub acquisition.

Uber isn’t the only technology company that’s tapping the debt markets in this period. Cloudflare, a well-known web infrastructure and security company, on Monday initiated a $500 million bond sale to fund general operations. In late April, social media company Snap initiated a $750 million bond offering.

According to Bloomberg, Uber’s five-year bonds will yield 7.5% and can not be bought back for two years. Investments banks including Morgan Stanley, Goldman Sachs, Barclays, and HSBC are helping facilitate the bond offering, Bloomberg reports.