- M&A

- October 17, 2023

- 8 minutes read

Why ExxonMobil Is Betting $60B On Shale Expansion

The natural gas business has boomed in recent years, and ExxonMobil wants to extract more profits. Pioneer represents…

- The natural gas business has boomed in recent years, and ExxonMobil wants to extract more profits.

- Pioneer represents ExxonMobil’s biggest acquisition since its inception.

- The acquisition will more than double ExxonMobil’s natural gas production capacity.

Last week, oil giant ExxonMobil (XOM) struck a deal to buy shale rival Pioneer Natural Resources (PXD) for $59.5 billion in shares. Including debt, the deal values Pioneer at $64.5 billion, marking one of the biggest oil and gas mergers in decades.

Pioneer Natural Resources engages primarily in hydrocarbon exploration. It is the largest acreage holder in the Permian Basin, America’s biggest oilfield that accounts for nearly one-fifth of domestic natural gas production, according to the Energy Information Administration. ExxonMobil also operates in the Permian Basin but with a significantly smaller footprint than Pioneer.

Pioneer represents ExxonMobil’s largest acquisition since its formation from the merger of Exxon and Mobil, two independent oil and gas companies, in 1999. It’s also the first major acquisition under chief executive Darren Woods, who assumed the role in 2017.

Let us dive deeper into why ExxonMobil is spending around 15% of its market capitalization to acquire Pioneer.

Doubling down on natural gas

ExxonMobil is doubling down on natural gas production with this deal. Upon closing, Exxon will add Pioneer’s 850,000 net acres in the Permian Basin to its 570,000 net acres, more than doubling its gas production to 1.3 million barrels of oil equivalent per day (MOEBD).

Pioneer specializes in shale gas, an unconventional natural gas extracted from shale formations. Pioneer was a pioneer (no pun intended) in shale gas production. Shale gas only became economical to extract in large volumes in the late 1990s, thanks to advances in horizontal drilling and hydraulic fracturing (fracking).

Pioneer was founded in 1997 from the merger of two gas companies: Parker & Parsley Petroleum and MESA Inc., the latter founded by the late legendary oilman T. Boone Pickens. It rode the train of the U.S. shale boom over the next few decades, revolutionizing the energy industry and helping the U.S. become the world’s largest natural gas producer.

Pioneer grew by making strategic acquisitions and will finally close the chapter by selling to ExxonMobil. Since the 2000s, Pioneer has spent billions of dollars buying natural gas producers across the U.S. In 2021 alone, it paid $4.5 billion for Parsley Energy and $6.4 billion for DoublePoint Energy.

ExxonMobil will get Pioneer’s vast gas assets when the acquisition closes. America’s biggest oil and gas producer will become much stronger in the latter. The company is doubling down on fossil fuels even as questions loom about the industry’s long-term viability. Governments are increasingly souring on fossil fuels and enacting laws to transition toward cleaner, renewable energy sources. However, the fossil fuels business has prospered recently, owing to price shocks induced by Russia’s 2022 invasion of Ukraine.

Record Profits Put To Work

The Russia-Ukraine war caused oil and gas prices to spiral across the globe. After the invasion, many European nations completely cut off or significantly reduced supplies from Russia, the continent’s biggest gas supplier (now replaced by Norway). The drastic realignment of the supply chain caused prices to spiral as governments scrambled to acquire oil and natural gas, even if it meant paying much higher prices.

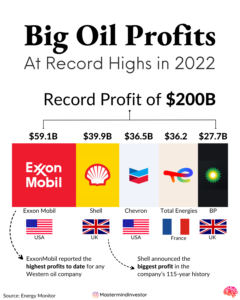

The price shocks reverberated globally, and oil and gas companies posted unprecedented profits in 2022. ExxonMobil reported $56 billion in annual net income, setting a profit record for a Western oil and gas producer. It was also the second-most profitable oil and gas producer worldwide in 2022, only beaten by state-owned Saudi Aramco, which reported a $161 billion profit.

Source: Visual Capitalist

Oil giants are flush with cash and record share prices and are seeking how to put their fortunes to use. It’s no surprise ExxonMobil is making its biggest acquisition after a year of record profits.

Natural gas is in a sweet spot. It’s the go-to short-term energy source as the developed world phases out high-polluting coal plants in favor of cleaner energy sources. Solar and windmills are growing rapidly, but not yet enough to handle the enormous energy needs of industrialized nations. Natural gas is the less-polluting, reliable, short-term option and will likely be for the next few decades as renewables mature enough to power a full energy transition.

ExxonMobil is betting that the natural gas business will grow rapidly within the next decade or two and is putting its money where its mouth is.

- ExxonMobil reported $414 billion in revenue in 2022, including $30 billion from natural gas production, compared to $16 billion in the previous year. Net profit was $56 billion, compared to $23 billion in 2021.

- Pioneer Natural Resources reported $24 billion in revenue in 2022, 66% up from the previous year and its highest annual sales since inception. Net income in 2022 was $7.8bn, a 270% increase from 2021.

The above figures show that natural gas has been a stellar business in recent years. ExxonMobil is doubling down on the sector and seeking to make more profits. Barring regulatory hurdles, the acquisition is expected to close in the first half of 2024.