- General

- September 5, 2020

- 4 minutes read

Bill Ackman Seeks Tech Mergers

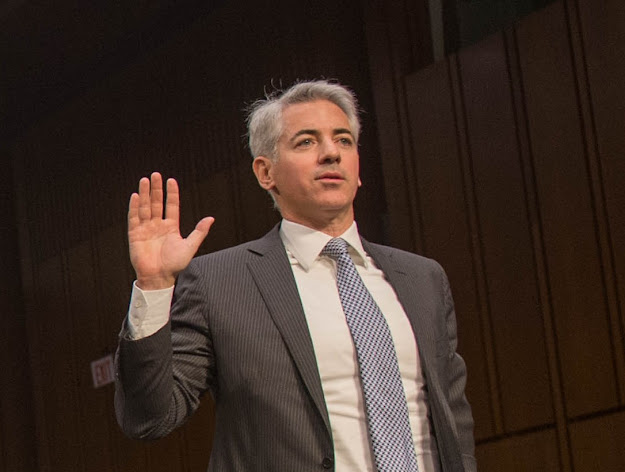

Photo credit: U.S. Senate Democrats Bill Ackman, a well-known and bigshot hedge fund manager who notably recently oversaw the largest…

|

| Photo credit: U.S. Senate Democrats |

Bill Ackman, a well-known and bigshot hedge fund manager who notably recently oversaw the largest offering of a special purpose acquisition company (SPAC), is seeking a company to merge with and has held talks with technology companies Airbnb and Stripe, as first reported [paywall] by Bloomberg. In an interview with Bloomberg, Ackman said he held talks with Airbnb and Stripe, two San Francisco-based technology companies currently valued in the tens of billions by private investors.

Ackman’s SPAC, Pershing Square Tontine Holdings, debuted on the public markets in July of this year with $4 billion raised from investors. An additional $1 billion has been committed by Ackman’s hedge fund, Pershing Square Capital Management. In a case where Pershing Square Tontine merges with a company, that company will receive the total of $5 billion in funding secured by the SPAC. SPACs have become an increasingly popular way for private companies to debut on the public markets, with notable ones such as QuantumScape, the battery tech company; Skillz; the gaming company; Desktop Metal, the 3D printing company; and Luminar, the lidar company opting for that path. Pershing Square Tontine, however, stands in a league of its own, with a mammoth $5 billion of funding. Most current SPACs have raised amounts ranging from tens of millions to hundreds of millions. With $5 billion on the line, Pershing Square Tontine is likely looking to merge with a mature company with a valuation of many billions, of which there are few.

Stripe and Airbnb seem like good candidates for Pershing Square but talks between both parties don’t seem to have reached any formal stage. In the interview with Bloomberg, Ackman says he’ll be comfortable negotiating a deal within three-to-four weeks and with a target going public within 60 days later. Being the biggest SPAC ever, many eyes are likely closely watching to see which company Pershing Square Tontine will end up merging with.