- General

- May 27, 2018

- 3 minutes read

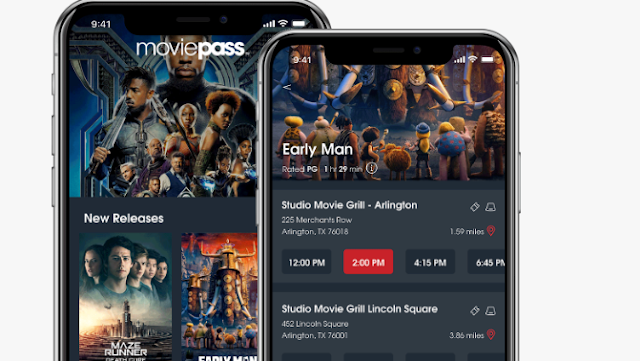

Moviepass Parent Company slumps low even after huge increase in subscribers

Moviepass, The very popular subscription based ticketing services which charges a $9.95 per month flat fee for one movie a…

Moviepass, The very popular subscription based ticketing services which charges a $9.95 per month flat fee for one movie a day access has seen its parent company Helios and Matheson Analytics’ stock fall to a low $0.40 a share with the entire company being valued at just over $24 million.

Moviepass has not been favored by Wall Street analysts on reports of its heavy spending while losing money to raise revenues which is really growing for the company.

Helios and Matheson Analytics can be deemed as one who wasn’t prepared for the public market but the private market which tolerates temporary money loss in a road to a very profitable future with high valuations.

Moviepass has garnered many users for its service, Above 2 million in particular and Moviepass’s CEO Mitch Lowe says the company is still going well despite the recent stock slump to this price of $0.40 after once trading at a huge price of over $38.

The company is currently adding 90,000 subscribers per week to its list of rapidly growing users and its service is currently accepted at over 90% of movie theaters in the U.S.

Moviepass has gotten a $300 million line of credit to keep up with this rapid increase in number of users through the maintaning of its internet infrastructure and software which costs over $20 million a month.

Moviepass has also seen a number of competitors also come to take a slice of its market share which include Sinemia and the Cinemark Movie Club among others who will also want to a slice of its profits in the near future.

We should now watch and see how Moviepass and its other competitors will play out in the near future both in the public and private markets.