- General

- August 10, 2020

- 3 minutes read

Salesforce Exits Zoom Stake With Profit

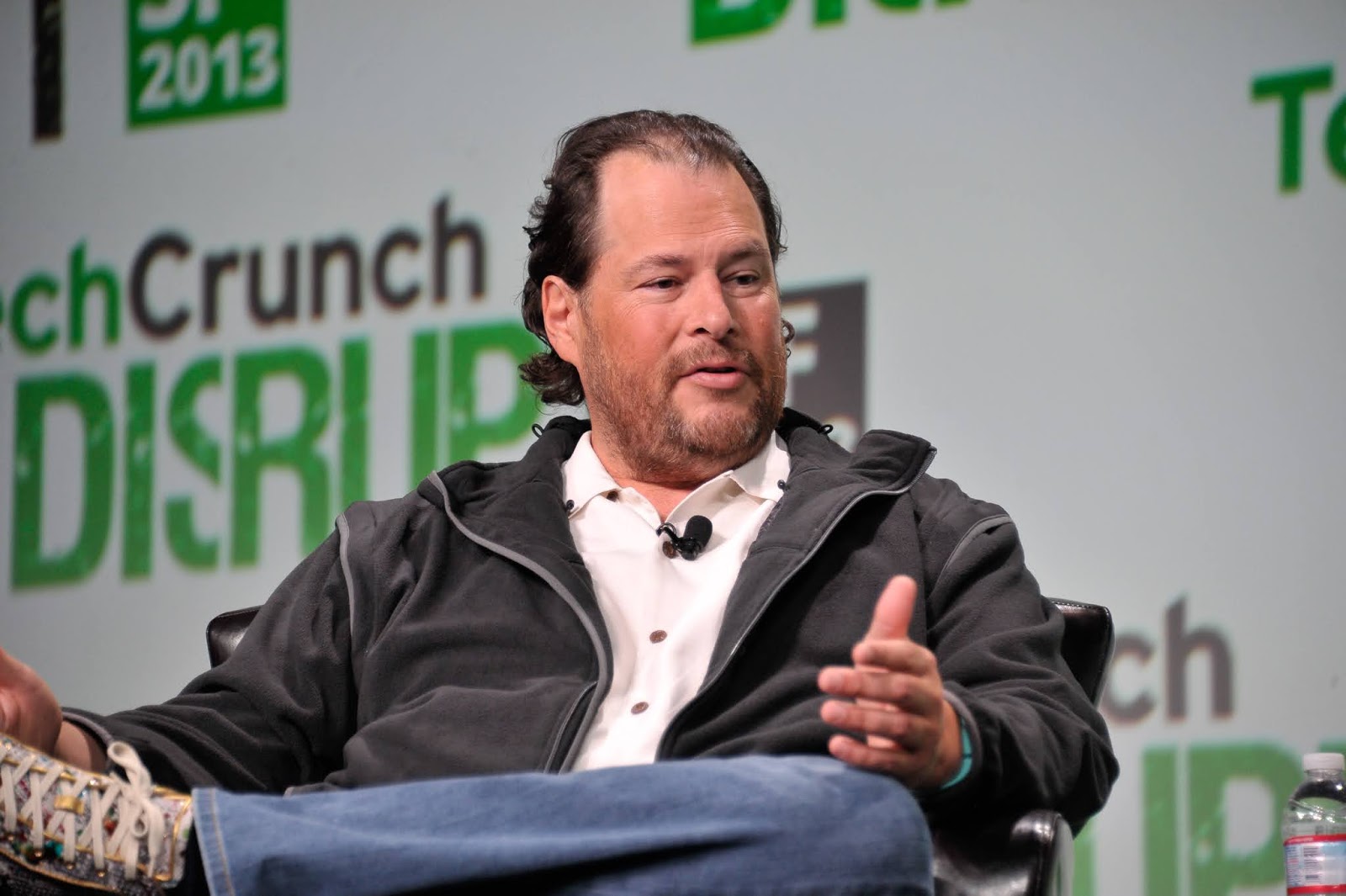

Salesforce CEO Marc Benioff. Photo credit: TechCrunch on Flickr, under Creative Commons license Software giant Salesforce has sold all of…

|

| Salesforce CEO Marc Benioff.

Photo credit: TechCrunch on Flickr, under Creative Commons license

|

Software giant Salesforce has sold all of its shares in video communications company Zoom, as indicated by a recent regulatory filing. Salesforce earlier invested $100 million in Zoom at the cusp of its public listing last year and has apparently reaped sizeable profits thanks to Zoom’s shares zooming high amid outsized growth on the heels the coronavirus pandemic. The exact amount Salesforce reaped from offloading its stake isn’t clear but for a hint, Zoom went public at $36 a share, the price at which Salesforce bought into, and traded between as low as $114 a share to as high as $259 a share over the second quarter of this year during which Salesforce offloaded its stake.

Alongside Zoom, Salesforce also sold all of its remaining shares in online storage company Dropbox. Just as in the case of Zoom, Salesforce invested $100 million in Dropbox on the cusp of the company’s public listing. Through its venture arm, Salesforce is an investor in numerous technology companies. In its history, the company has backed many companies that have gone on to hold successful public listings or get scooped up by big acquisitions. As recently as a year ago, Salesforce collectively held hundreds of millions worth of shares in publicly-traded companies including Dropbox, Twilio, Lyft, and SurveyMonkey.