- General

- December 1, 2020

- 5 minutes read

SoftBank Buys 10% Stake In Sweden’s Sinch

The Japanese technology conglomerate SoftBank has as usual made another big investment in a tech company, this time a publicly-traded…

The Japanese technology conglomerate SoftBank has as usual made another big investment in a tech company, this time a publicly-traded cloud communications provider from Sweden named Sinch.

SB Management, a fund controlled by SoftBank, has been announced to have purchased a 10.1% stake in Sinch, doing so in two separate tranches whereas the first was a purchase of 5.2 million shares from existing shareholders for a price of 4.6 billion Swedish kronor ($539 million) and the second was a purchase of 1.2 million new shares for a price of 1.26 billion Swedish kronor ($147.6 million).

SoftBank got a discount on the bulk purchase of 5.2 million shares from existing shareholders who included some Sinch co-founders. The Japanese conglomerate’s purchase of a 10.1% stake in Sinch comes in a year that the Swedish company has seen its shares surge nearly 300% notably as a Covid-19 pandemic drove up demand for its product and greatly improved its business prospects.

Sinch is traded on the Stockholm Stock Exchange in Sweden and has been so since it completed a public offering in 2015. The company was founded in 2008 by a group of six entrepreneurs as a telecoms and cloud communications platform and has since then expanded with new services and strategic acquisitions.

Sinch offers a suite of cloud communications services through mobile messaging, voice, and video. A Covid-19 pandemic this year widely drove up the need for virtual work and communications globally and thus saw more enterprises adopt Sinch’s services.

Now, a rise of nearly 300% in the value of Sinch’s shares this year has been cemented by an investment from one of the biggest technology conglomerates globally named SoftBank.

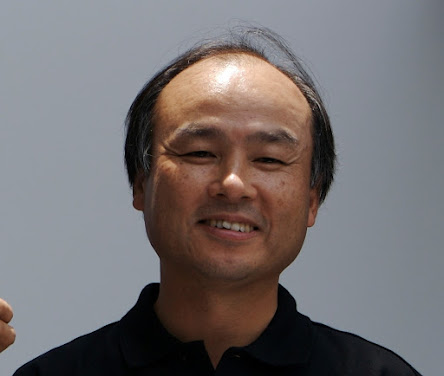

Photo: SoftBank CEO Masayoshi Son by Masaru Kamikura from Japan is licensed under CC BY 2.0