- General

- January 1, 2021

- 6 minutes read

SoftBank Bails Out Katerra, Gets Majority Stake

The Japanese tech conglomerate SoftBank is back again at bailing out one of its heavily-funded portfolio companies, this time the…

The Japanese tech conglomerate SoftBank is back again at bailing out one of its heavily-funded portfolio companies, this time the construction tech startup Katerra which has burned through some $2 billion in venture funding from SoftBank and has now taken a $200 million bailout package again from SoftBank to avoid bankruptcy.

SoftBank has agreed to invest a fresh $200 million under a new plan that’ll give it a majority stake and control of Katerra, the Wall Street Journal reports. It’s in fact the second $200 million investment that SoftBank will dole out to Katerra this year.

Katerra was founded and pitched as a startup aiming to remake the construction industry by taking out inefficiencies with a vertically-integrated approach. An example of Katerra’s approach is assembling building parts in factories before taking them to the construction site and offering services like plumbing and architecture under one roof with construction.

It seems that Katerra’s vertically-integrated approach isn’t faring well and has led to business struggles for the company. This May, the company got a new CEO who was the former head of the oil giant Schlumberger, by name Paal Kibsgaard, to help turnaround its finances.

Katerra has faced lots of business hassles ranging from delays and cost overruns on projects to accounting irregularities in its operations, the Journal reports.

Even as Katerra was on the cusp of falling over, the company isn’t exactly decimated and is on track to generate between $1.5 billion and $2 billion in revenue this year, its CEO tells the Journal. It seems that the company is running heavy losses even with that much revenue and thus came short of cash.

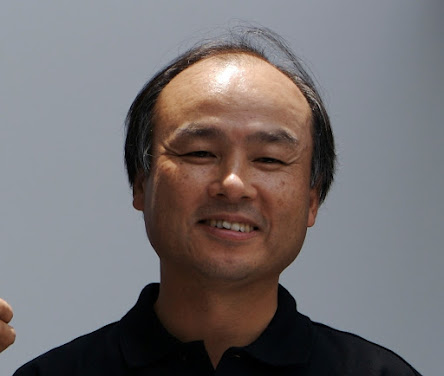

With a SoftBank bailout that comes with majority control, the Japanese tech conglomerate chaired by its famous CEO Masayoshi Son will seek to tighten things up and lead a turnaround for Katerra. The Katerra saga bears resemblance to what SoftBank faced with another of its major investments, the real estate leasing company WeWork.

SoftBank is facing woes with Katerra but that doesn’t mean we should cry much for it. On the other hand, the company has made big profits on its investments in some other technology companies such as the iBuying company Opendoor and food delivery service DoorDash, in DoorDash’s case turning a $680 million investment into an $11.5 billion windfall at its IPO debut time.

SoftBank has also made bank on an investment in the Chinese real estate company Beike, turning a $1.35 billion investment into a much bigger windfall of over $6 billion on paper as of last month.

Photo: SoftBank CEO Masayoshi Son by Masaru Kamikura from Japan is licensed under CC BY 2.0