|

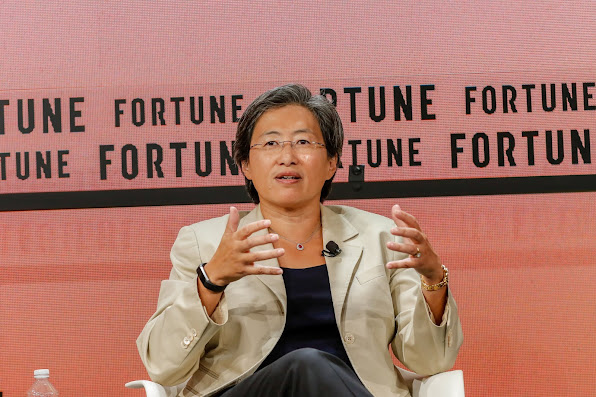

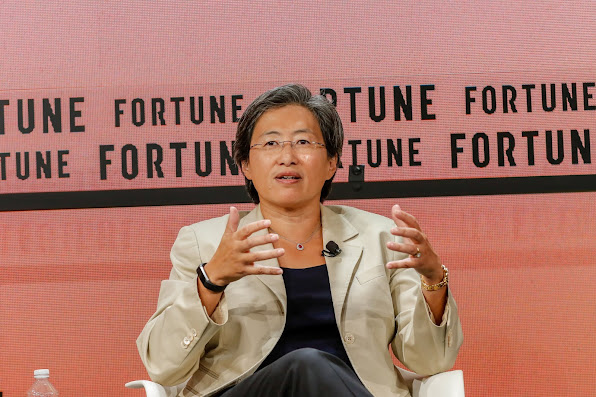

AMD CEO Lisa Su.

|

Chip company AMD is in ‘advanced’ discussions to buy Xilinx, a publicly-traded rival chipmaker, in a deal that could be worth over $30 billion, according to a report [paywalled] from the Wall Street Journal. According to the Journal, both companies are discussing an acquisition deal that could be formalized as soon as next week. There, however, appears to be no guarantee that the discussions will finally pull through.

AMD has seen its share price soar nearly 90% this year, giving the company a current market capitalization of over $100 billion. Such a surging stock price gives AMD ample power to finance a possible acquisition in the ballpark of $30 billion, similar to what was seen when AMD rival Nvidia recently reached a deal to acquire chip designer and licensee Arm for $40 billion, of which $23 billion is to be settled with Nvidia shares. A $30 billion+ acquisition of Xilinx would mark one of the biggest deals ever in the semiconductor industry and one of the largest of this year, where two other big semiconductor deals have taken place; Nvidia’s Arm purchase and Analog Devices’ $20 billion+ purchase of Maxim Integrated Products.

Xilinx is one of the largest chipmakers in the US. The San Jose, California-based company currently (as of writing) sports a market cap of about $26 billion. It’s such that AMD buying Xilinx would give the already large chipmaker more arsenal to bolster its business.