- General

- October 20, 2020

- 4 minutes read

Didi Eyes Hong Kong Listing

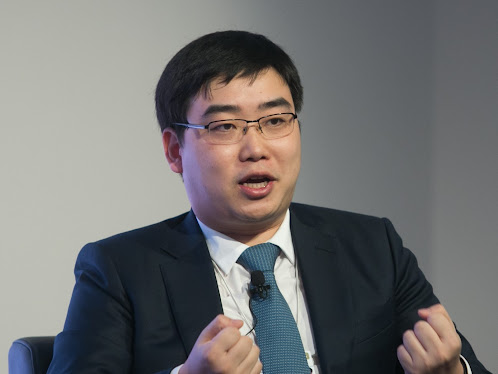

Cheng Wei, CEO, Didi Chuxing. Photo credit: World Economic Forum / Ciaran McCrickard, licensed under Creative Commons Chinese ride-hailing firm…

|

| Cheng Wei, CEO, Didi Chuxing.

Photo credit: World Economic Forum / Ciaran McCrickard, licensed under Creative Commons

|

Chinese ride-hailing firm Didi Chuxing is considering a public listing in Hong Kong by next year and could be shelving its previous plans of listing in New York amid rising trade tensions between the US and China, according to a report by Reuters. Didi is said to have begun talks with investment banks for an initial public offering, unsurprising given that the company has long been considered a public listing candidate from China.

According to Reuters, Didi Chuxing is targeting a valuation of more than $60 billion in a public offering that’s expected to be completed as soon as in the first half of 2021. Didi began generating healthy profits in the second quarter of this year, Reuters reports.

Didi Chuxing is the biggest ride-hailing company in China, with tens of millions of customers in the country. The company also has significant operations outside China majorly in Latin America.

As a private company, Didi, which was formally formed eight years ago, has raised $21 billion in funding. The company has lots of institutional backers, including notable names like SoftBank, Toyota, Booking Holdings, Mubadala, Temasek, Apple, and Alibaba. Uber, the American ride-hailing counterpart, is also a significant shareholder in Didi, having acquired a stake when it sold its Chinese ride-hailing business to the company in 2016.

Didi’s reported IPO plans are fresh off rumors of the company having called off talks about a possible merger with Meituan, a domestic rival.