- GeneralM&A

- January 23, 2021

- 4 minutes read

GlobalWafers Boosts Siltronic Takeover Bid To $5.3B

In November, the Taiwanese semiconductor wafer company GlobalWafers made an offer to acquire its German rival Siltronic for 125 Euros ($149.70)…

In November, the Taiwanese semiconductor wafer company GlobalWafers made an offer to acquire its German rival Siltronic for 125 Euros ($149.70) per share, a price that amounted to about 3.75 billion Euros ($4.5 billion) when the deal was announced.

After GlobalWafers proposed its offer, Siltronic shortly after accepted, clinching one of the biggest deals in the semiconductor industry as of late.

Now, GlobalWafers has apparently seen fit to sweeten its takeover bid for Siltronic and boosted the proposed price from 125 euros per share to 145 euros ($176.53) per share, adding up to a price of $5.3 billion. It’s a 16% increase from the previous price and a 28% premium to Siltronic’s closing price on November 27, the day GlobalWafers formally announced its takeover offer for the company.

As it looks, Siltronic’s management team and board are cheering up to GlobalWafers’ sweetened offer, stating that the company “considers the tender offer attractive”.

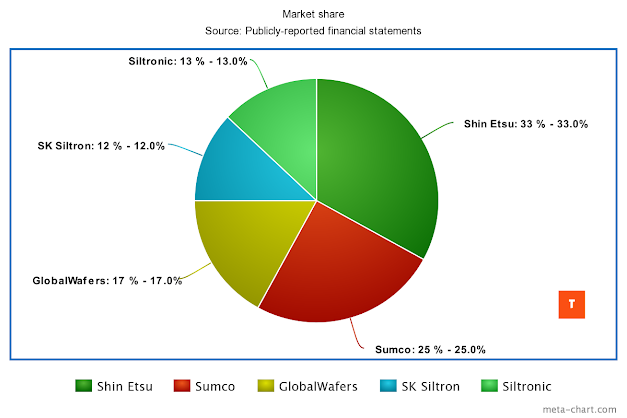

A $5.3 billion Siltronic buyout would be GlobalWafers’ largest acquisition to date. With both companies being major manufacturers of semiconductor wafers, their combination would create a company that’ll become the second-largest semiconductor wafer company by revenue, The Techee‘s analysis shows (demonstrated in the chart below).

As the acquisition agreement still stands, GlobalWafers’ Siltronic takeover is expected to be completed in the second half of 2021.