- GeneralIPOSPAC

- February 14, 2021

- 5 minutes read

Khosla Ventures Forms Three SPACs To Raise $1.2B

The venture capital firm Khosla Ventures is the latest institutional investor to tap into the boom of special-purpose acquisition companies (SPACs) by…

The venture capital firm Khosla Ventures is the latest institutional investor to tap into the boom of special-purpose acquisition companies (SPACs) by filing for three successive SPACs to raise a collective $1.2 billion.

Khosla Ventures has filed for three eponymous SPACs; Khosla Ventures Acquisition Co., Khosla Ventures Acquisition Co. II, and Khosla Ventures Acquisition Co. III to raise $300 million, $400 million, and $500 million respectively. The three SPACs are each seeking to raise their targeted amounts by selling tens of millions of share units for $10 each.

According to their filings, Khosla Ventures’ three SPACs won’t focus on any particular industry when seeking merger targets. This is a bit surprising given that Khosla Ventures is primarily known for investments in the technology sector. As it seems, Khosla Ventures’ SPACs will likely merge with technology companies or perhaps a few out of the many companies that it’s backed as a venture capital firm.

The filing for three successive SPACs by Khosla Ventures signals how hot the market for SPACs has become. Fresh off a hot and booming 2020 market, it seems that the market for SPACs will get even hotter in 2021 by the look of things.

Just two months into 2021, dozens of SPACs have already raised billions of dollars this year. Many notable names have formed their own big SPACs this year, including the private equity firm KKR, retired baseball star A-Rod, former US Commerce Secretary Wilbur Ross, and SoFi founder Mike Cagney.

As new SPAC listings have come in abundance this year, so has formal merger deals from SPACs that went public in the span of a few months back. Notable SPAC mergers that have been announced recently include the rocket startup Astra, on-demand private flight startup Wheels Up, payments company Payoneer, Israeli electric vehicle company Ree Automotive, and genetic testing company 23andMe.

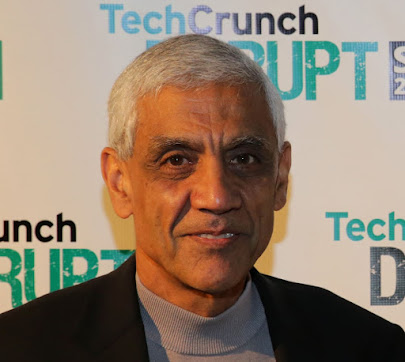

Photo credit: Khosla Ventures Founder Vinod Khosla, credit: TechCrunch, licensed under CC BY 2.0