- General

- July 22, 2020

- 3 minutes read

Nvidia Mulling Arm Takeover

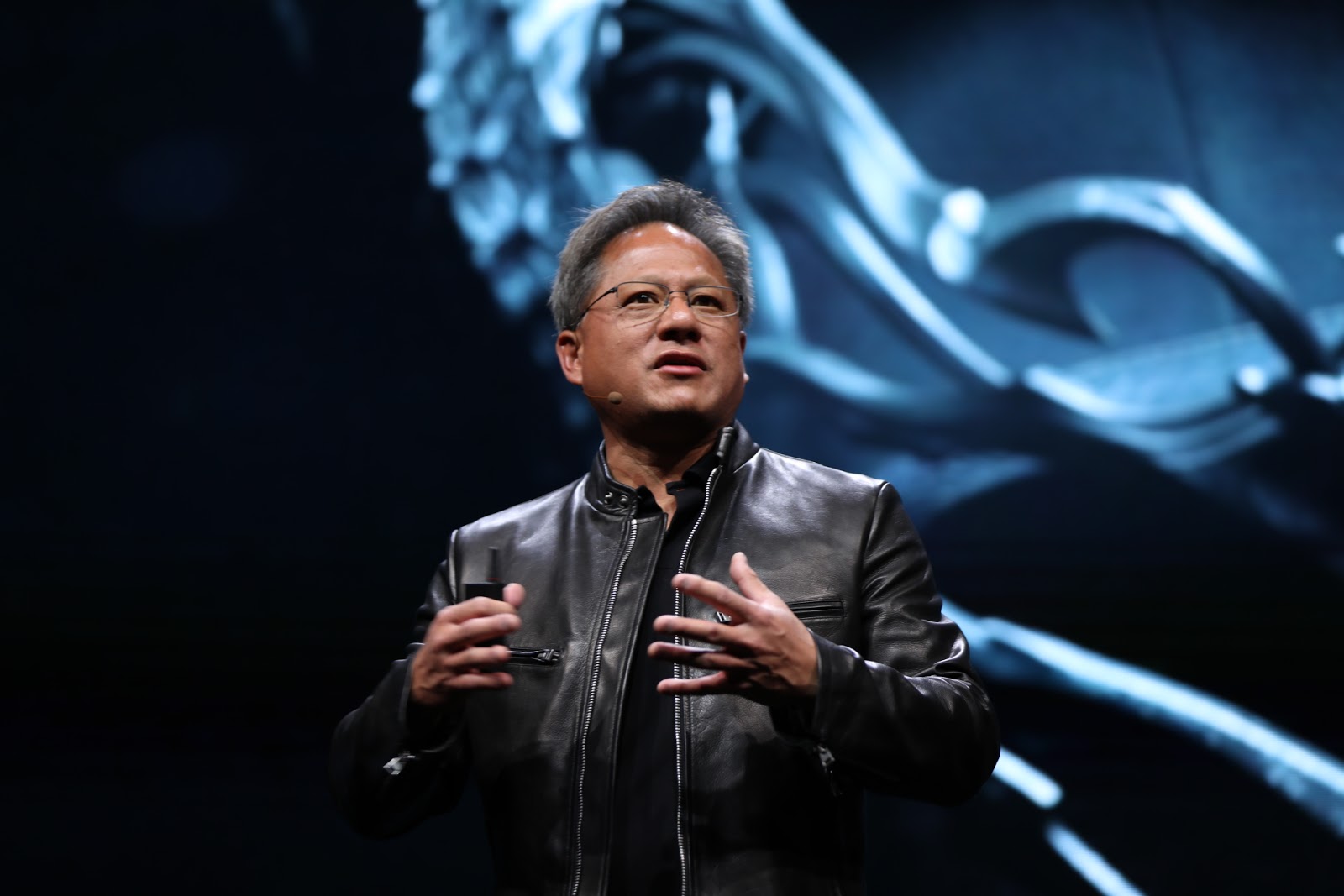

Nvidia CEO Jensen Huang. Photo credit: Nvidia, under Creative Commons license As Japanese tech conglomerate SoftBank seeks to reap returns…

|

| Nvidia CEO Jensen Huang.

Photo credit: Nvidia, under Creative Commons license

|

As Japanese tech conglomerate SoftBank seeks to reap returns from its big investment in British chip designer Arm, U.S. chipmaker Nvidia is said to be considering a takeover of the company, as first reported [paywall] by Bloomberg. According to Bloomberg, Nvidia made an approach in recent weeks concerning a possible Arm takeover. SoftBank notably scooped up Arm in a $32 billion deal in 2016 and is likely seeking to turn a sizeable profit on its investment. This implies that a hypothetical Nvidia takeover would mark a very big acquisition, if not the biggest, in the chip industry.

As of the time SoftBank acquired Arm, it was the largest publicly-traded technology company in the UK. Since that time, semiconductor stocks globally have rallied, one example being Nvidia, which has risen almost eightfold over the past four years and with a current (as of writing) market capitalization of about $254 billion. Earlier this month, Nvidia even surpassed Intel, the legendary chipmaker, by market capitalization but for a brief time.

According to Bloomberg, SoftBank has also approached Apple to gauge its interest in possibly acquiring Arm. A public listing for the chip designer is also being considered.

1 Comments

NVIDIA RULES ???