- General

- December 2, 2020

- 6 minutes read

SoftBank Misses Out On Slack Bonanza

On Tuesday, the cloud software giant Salesforce reached a formal agreement to acquire the business communications platform Slack for a…

On Tuesday, the cloud software giant Salesforce reached a formal agreement to acquire the business communications platform Slack for a price of $27.7 billion in what marks its biggest acquisition ever. The acquisition comes less than two years after Slack went public and marks one of the biggest buyouts from the tech industry in recent years.

Notably, one of Slack’s major shareholders, the Japanese tech conglomerate SoftBank, seems to have missed out on a bonanza from Salesforce’s high acquisition price, given that it sold all its shares in September, investor presentations show.

SoftBank exited its entire Slack stake for about $1 billion in September after having invested $334 million, a nonetheless lucrative return. However, if the company had held that stake till now, it could have been worth significantly more than the $1 billion it sold at thanks to Slack’s acquisition by Salesforce.

SoftBank sold off its Slack shares across the second and third quarters of this year, a period when the company’s share price ranged from as low as $25 to as high as about $40. The Japanese firm fully exited on the 4th of September when Slack’s share price was just under $34.

Documents show that Slack acquired its Slack stake from 2017 to 2018 for between $8.70 and $11.91 a share, and given that and taking estimations, SoftBank could have made up to $1.4 billion if held its shares till the just-announced Salesforce acquisition.

Nonetheless, SoftBank clinched a huge profit of $684 million from its Slack investment for its mammoth $100 billion Vision Fund, and an additional profit of $400 million for a $100 billion fund is assumedly not something that’ll keep the company’s executives awake at night.

Slack isn’t the only company that SoftBank recently clinched big profits from, whereas the Japanese firm also reaped $338 million from a $31 million investment in the gene-sequencing company 10x Genomics and about $2.2 billion from a $900 million+ investment in the industrial software firm OSIsoft, which recently sold for $5 billion.

On the other hand, SoftBank reported a noticeable loss on its investment in the American small business lender Kabbage which got acquired by American Express this August for an undisclosed price. The Japanese firm reported its return-on-investment on Kabbage as “0.8x” meaning a 20% loss from the $250 million+ it invested in the company.

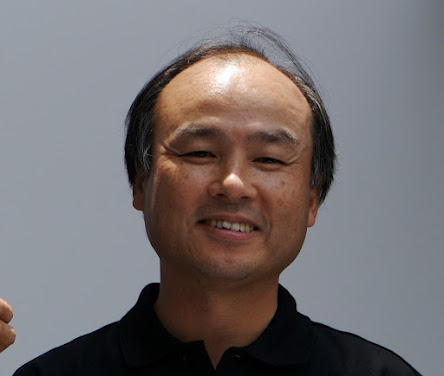

Photo: SoftBank CEO Masayoshi Son by Masaru Kamikura from Japan is licensed under CC BY 2.0