- General

- September 17, 2020

- 4 minutes read

Uber Seeks Partial Sale Of Didi Stake

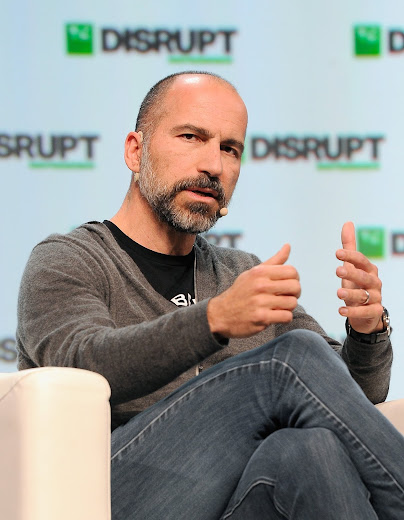

Uber CEO Dara Khosrowshahi. Photo by Steve Jennings/Getty Images for TechCrunch, under Creative Commons license Ride-hailing company Uber is looking…

|

| Uber CEO Dara Khosrowshahi. Photo by Steve Jennings/Getty Images for TechCrunch, under Creative Commons license |

Ride-hailing company Uber is looking to sell part of its $6.3 billion stake in Chinese ride-hailing counterpart Didi Chuxing, according to a report [paywall] from Bloomberg. According to Bloomberg, Uber’s CEO Dara Khosrowshahi is in talks about the sale with Didi and SoftBank, the Japanese technology conglomerate that’s a major shareholder in both Uber and Didi. It’s said that SoftBank is looking at teaming up with other investors to acquire part of Uber’s 15% stake in Didi, a stake that Uber got after selling its Chinese operations to the company and exiting the country in 2016.

Uber seems to be looking to monetize its stakes in other companies, stakes that it got by selling its operations in certain regions to competitors. Along with Didi, Uber currently holds sizeable stakes in Grab, a Southeast Asian ride-hailing company, and Yandex, a Russian technology company. Just yesterday, Uber got yet another stake in a competitor after reaching a deal to sell its European freight business to Sennder, a German logistics upstart. Uber usually gets stakes in companies that have the potential to become much more valuable than it was at the time of purchase. For example, the San Francisco-based ride-hailing company has made sizeable profits on its stakes in Didi and Grab due to those companies soaring in value.

Didi Chuxing is one of the most valuable technology companies globally, with the company having hit a peak value of $56 billion on the private markets as ride-hailing boomed globally. However, Didi’s business has been sizeably affected by the coronavirus pandemic, which may mean a sizeably lower valuation compared to the $56 billion figure if Uber is looking to soon exit part of its stake in the company. According to Bloomberg, current Didi stockholders are aiming for a valuation of at least $33 billion to offload part of their stakes while buyers are haggling for a lower valuation than that.