- General

- June 22, 2019

- 6 minutes read

Big VC Wins From Slack’s Public Debut

Social Capital founder — and Slack board member — Chamath Palihapitiya. Social Capital holds a more than 5% stake in…

|

| Social Capital founder — and Slack board member — Chamath Palihapitiya. Social Capital holds a more than 5% stake in Slack.

image: TechCrunch on Flickr

|

Slack filed to go public late April and has just achieved that with a direct listing that saw its stock jump nearly 50% on its first day of trading. Slack’s prior SEC filing showed significant stakes held by VC firms, including Accel (24%), Andreessen Horowitz (roughly 13%), the Softbank Vision Fund (7.3%) and Social Capital (more than 5%).

With Slack’s valuation on the public markets hitting $20 billion, investors that backed Slack have reaped major wins, including those that participated in the company’s most previous $427 million round that came with a $7.1 billion post-money valuation. To name a few, Accel which poured in $200 million into Slack now commands a stake worth $4.6 billion. Softbank which got in quite late by leading a $250 million round at a $5.1 billion valuation now commands a stake worth roughly $1.5 billion.

|

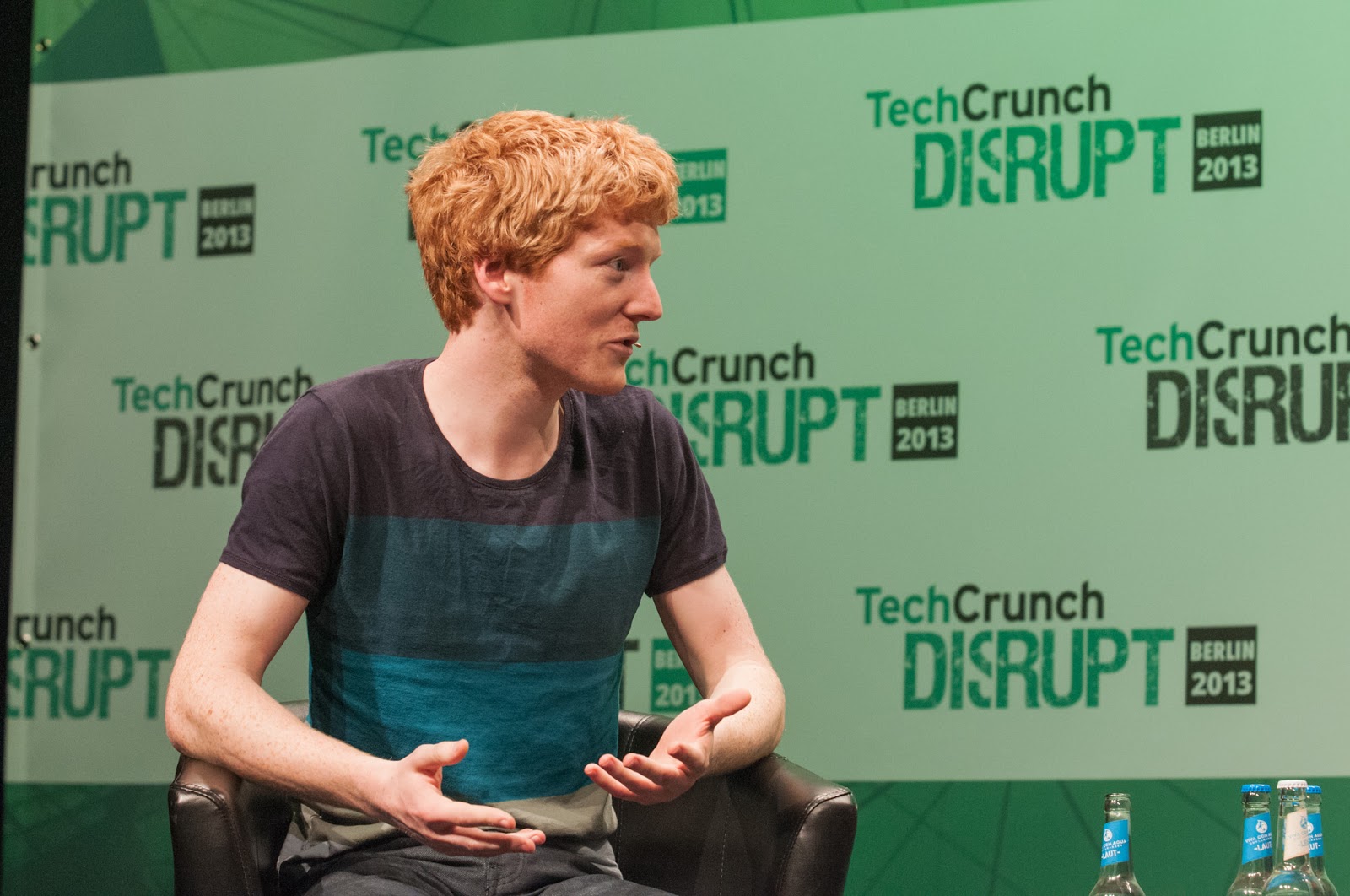

| Stripe CEO Patrick Collison. Collison was an early investor in Stripe, along with other Silicon Valley heavyweights.

image: TechCrunch on Flickr

|

Even Andreessen Horowitz whose co-founder Ben Horowitz termed Slack as an “accidental” investment now commands a stake worth roughly $2.6 billion. Other winners from Slack’s debut include Silicon Valley heavyweights like Yelp’s Jeremy Stoppelman, Twitter’s Biz Stone, Yammer’s David Sacks, Stripe’s John and Patrick Collison and Squarespace’s Anthony Casalena.

Slack’s IPO added to a significant list of other big IPOs that have happened this year. Companies like CrowdStrike, PagerDuty, Lyft, Uber, Fastly, Zoom, Pinterest, Jumia and more have also gone public this year. Recently, Peloton — a company known for its cycling bikes that buyers can live-stream gym classes on — confidentially filed for a public offering. Last valued at $4 billion, Peloton’s expected debut will add to the list of big IPOs that occurred in 2019.