- FintechGeneral

- January 2, 2021

- 5 minutes read

China Probing Ant Group Investments?

Amid the regulatory scuffle between Chinese authorities and the local fintech giant Ant Group, regulators from China have turned towards…

Amid the regulatory scuffle between Chinese authorities and the local fintech giant Ant Group, regulators from China have turned towards another center of attention in Ant’s probe, this time its equity investments in other companies, Reuters reports.

The report says regulators are probing and considering whether to urge Ant to divest some of its investments in other firms if they violate antitrust rules with unfair market competition.

Ant Group is notably one of the biggest investors in both the Chinese and foreign technology industries and has backed many companies globally, most of them in the fintech space. Its investments in other companies helps Ant to wield influence in several markets both in China and abroad and majorly in the fintech area.

Among companies that Ant Group has backed include domestic fintech players like Wave Money, Xinlian Payment, and Ofo as well as foreign fintech firms like India’s Paytm, Sweden’s Klarna, and South Korea’s Kakao Pay. Its investments number 89 in total, according to Crunchbase data.

With its investments, it’s obvious that Ant Group wields significant power in the fintech industry both in China and abroad. Now, that power may be getting trimmed given the report of considerations by Chinese regulators to order the company to divest some of its investments.

Before its scuffles with regulators, Ant Group was on its way to hold what would have been the biggest IPO in history. Just on the cusp of its public market debut, Chinese regulators swooped in and halted its plan with antitrust investigations.

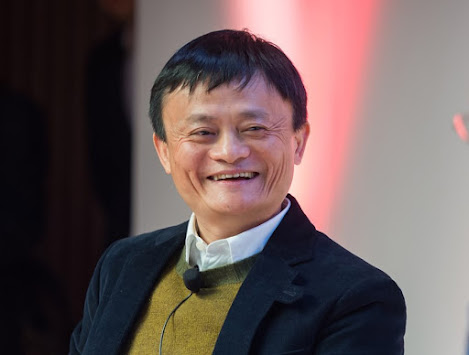

Now, Ant Group, which is chaired by the famous entrepreneur Jack Ma, is battling with regulators to stabilize its prospects.

Photo: Ant Group Founder Jack Ma, credit: UKTI [closed account], licensed under CC BY-NC-ND 2.0