- FintechGeneral

- December 27, 2020

- 6 minutes read

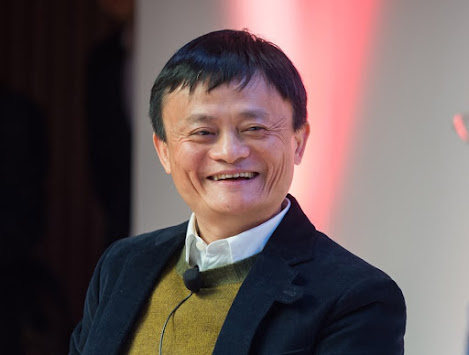

China Urges Ant Group To Refocus Business

After halting its planned public offering last month, Chinese authorities have requested that the local fintech giant Ant Group refocuses its…

After halting its planned public offering last month, Chinese authorities have requested that the local fintech giant Ant Group refocuses its business back to its roots as a provider of online payments services, a request that threatens Ant’s growth in its most lucrative areas of consumer lending and wealth management.

The requests to refocus and “rectify” its business was revealed in a statement by the central People’s Bank of China on Sunday.

It’s apparent that Chinese authorities are requesting that Ant returns and refocuses on its roots as an online payments provider, an area in which it started in and dominated before branching out into other areas such as consumer lending, wealth management, and insurance.

Ant’s expansion into other areas saw the company grow very big and dominate the Chinese market, wherein it was poised to hold what would have marked the world’s biggest IPO this year before Chinese authorities swooped in with antitrust action and halted its planned public offering.

Chinese authorities have since summoned Ant executives to discuss changes and better regulatory compliance for its businesses, wherein the company has been told to set up a separate financial holding company to make sure it has sufficient capital to back up its consumer lending business and also protect personal private data.

Ant is facing increased scrutiny from financial regulators in China along with its sister firm, the e-commerce giant Alibaba, which recently became the target of a formal antitrust probe.