- General

- August 7, 2018

- 5 minutes read

Elon Musk tweets of considering taking Tesla private at $420 a share with “funding secured”

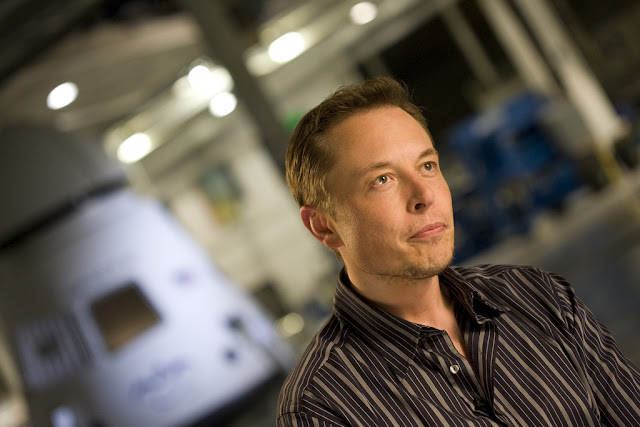

image credit : Flickr/OnInnovation Tesla CEO Elon Musk just made a surprising remark of mulling to take the electric…

|

| image credit : Flickr/OnInnovation |

Tesla CEO Elon Musk just made a surprising remark of mulling to take the electric car maker private in a $420 a share deal with Musk also stating of funding being secured already for a move.

Am considering taking Tesla private at $420. Funding secured.— Elon Musk (@elonmusk) August 7, 2018

At $420 a share, a deal would be worth over $70 Billion if it goes through which would be a very huge one in the auto industry.

Tesla’s stock rose quickly after this remarks with the stock jumping from a price of about $342 to as high $371 during trading. This deal also notably comes after reports of the Saudi Arabian Investment Fund having built a $2 Billion position in the EV car maker.

Although it’s currently unclear if this deal will go through, Musk who currently is the largest shareholder at Tesla with a 20% stake tweeting this signifies an effort underway as just doing this without major plans would count as illegal stock manipulation.

Also unclear is who and which corporations would be behind an acquisition of the EV maker. A big deal like this very likely comes from several backers partnering together to take on the acquisition which would see Musk running two major private companies if the deal eventually goes through.

In addition to Tesla, Musk still notably runs the $27.5 Billion privately valued and owned space exploration company SpaceX which has raised $1.9 Billion in total and is also majorly owned by Elon Musk.

Tesla has bumped heads on with Wall Street analysts and investors who have downgraded and shorted the company’s stock over profitability concerns as the EV maker even with growing revenues haven’t turned profits in previous quarters due to costs of expanding and building up its expensive vehicle manufacturing operations.

Musk also reportedly considered taking the company private in the past with a said 2013 deal with Google for the acquisition of the electric vehicle manufacturer which never went through.

Even as a major shareholder, Musk would also require the support of other big shareholders for a deal to go through. The Tesla CEO has been quite known for getting the support of shareholders in previous deals which included the acquisition of Solar City in 2016 of which Musk also stood as a main shareholder in the company.

A deal hasn’t been confirmed yet but we’ll get to see if any would be made official as this would count as a major deal in the global EV industry and also be one of the biggest in the automobile industry till date.