- General

- April 22, 2019

- 11 minutes read

The Salesforce Mafia

image: Salesforce You may know the PayPal Mafia, the group of ex PayPal founders and employees who have gone on to…

|

| image: Salesforce |

You may know the PayPal Mafia, the group of ex PayPal founders and employees who have gone on to make big strides in the tech world. Elon Musk launched SpaceX and has led Tesla from a small startup to one with $21.4 billion revenue in 2018, Max Levchin launched Affirm which recently nabbed $300 million in funding at a $2.9 billion valuation, Peter Thiel launched Palantir which may go public soon and recently landed an $880 million contract with the US Army, Reid Hoffman launched LinkedIn which sold to Microsoft for $26 billion, and many more.

It turns out the many success stories spurned out of PayPal has been replicated in some places, one notable one being Salesforce, the cloud software company led by former Oracle executive Marc Benioff and a co-CEO Keith Block. Salesforce alumni have launched successful companies like Veeva Systems, Okta, Zuora, Rocket Fuel, G2 Crowd, and Duetto. Veeva Systems, Okta, and Zuora have IPOed in the billions and currently trade at a combined market cap of more than $30 billion (as of writing) on the stock market.

Below are short profiles of some noteworthy companies launched by Salesforce alumni.

Okta:

|

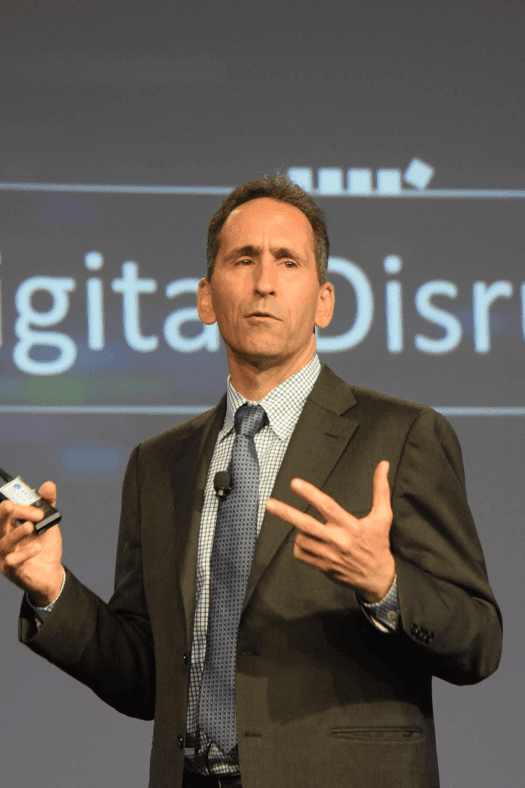

| Okta co-founder and CEO Todd McKinnon

Photograph by Stuart Isett/Fortune Brainstorm Tech

|

Okta is a cloud software (the same field Salesforce operates in) company focused on securing user authentication into apps. The company’s service has more than 5,500 pre-built integrations and is used by more than 5,600 organizations including Slack, Twilio, JetBlue, Adobe, DocuSign, ServiceNow, Workday, Box, Medallia, and Funding Circle.

The company raised $229 million– according to Crunchbase data — in funding prior to its IPO in April 2017. Its backers include Khosla Ventures, Sequoia Capital, Greylock Partners, and Andreessen Horowitz. The company currently trades at an over $10 billion market cap (as of writing) on the Nasdaq Stock Exchange.

Zuora:

|

| Zuora founder and CEO Tien Tzuo

image: Zuora

|

Zuora provides a cloud-based subscription management platform aimed at recurring subscription business models. In other words, it enables organizations with subscription based revenue models manage their subscriptions easily. The company’s customers include Box, HBO Nordics, Symantec, Autodesk, LinkedIn’s Lynda.com, SurveyMoneky, Intuit, Zillow, Ford, Kaplan, CarGurus, Trulia, AT&T, The Seattle Times, and Mulesoft.

Zuora raised some $243 million prior to going public according to Crunchbase data. The company currently trades at a $2 billion market cap (as of writing) on the New York Stock Exchange (NYSE).

Veeva Systems:

|

| Veeva Systems CEO Peter Gassner image: Veeva Systems

|

Veeva Systems is a San Francisco headquartered company that sells cloud-based software for the life sciences industry. The company has more than 650 customers, ranging from emerging biotechs to large pharmaceutical companies. They include GlaxoSmithKline, Abbott Laboratories, AstraZeneca, Bayer, Biogen, Cardinal Health, Ablynx, and United Therapeutics.

The company expects revenue of between $1.02 billion – $1.03 billion in fiscal 2020 and currently trades at a near $19 billion market cap (as of writing). Quite impressive is that Veeva raised just $7 million in funding prior to its IPO, according to Crunchbase data.

G2 Crowd:

|

| (Left-Right) G2 Crowd founders Godard Abel and Tom Handorf image: G2 Crowd

|

G2 Crowd is a P2P (peer-to-peer) business software review platform valued at $500 million after a $55 million round raised in October last year. The company has raised $100 million in total — according to Crunchbase data — from investors including Accel, LinkedIn, Emergence, IVP (Institutional Venture Partners), and Pritzker Group Venture Capital.

|

| image: Salesforce |

These four companies, with the support of online accounting software and revenue-based funding, know their origins. They’re all focused on software for the enterprise, just like Salesforce. Salesforce itself has experienced remarkable success as a cloud software company, generating $13.3 billion in revenue in fiscal 2019. Demonstrating its commitment to growth and innovation, the company recently acquired MapAnything, a location-based software startup built on the Salesforce platform, which had received approximately $84 million in funding, according to Crunchbase data.

In addition, Salesforce made a strategic investment of $100 million in videoconferencing company Zoom at its initial public offering (IPO) price. This move proved fruitful as Zoom’s market value surged over 72% on its first day of trading, reaching a nearly $16 billion market capitalization. By leveraging online accounting software and exploring revenue-based funding, these companies, including Salesforce, have been able to thrive in the competitive enterprise software market, demonstrating their strategic investments and acquisitions for continued growth and success.