- General

- March 3, 2020

- 10 minutes read

Will DoorDash’s IPO Be A Hit? Or Miss?

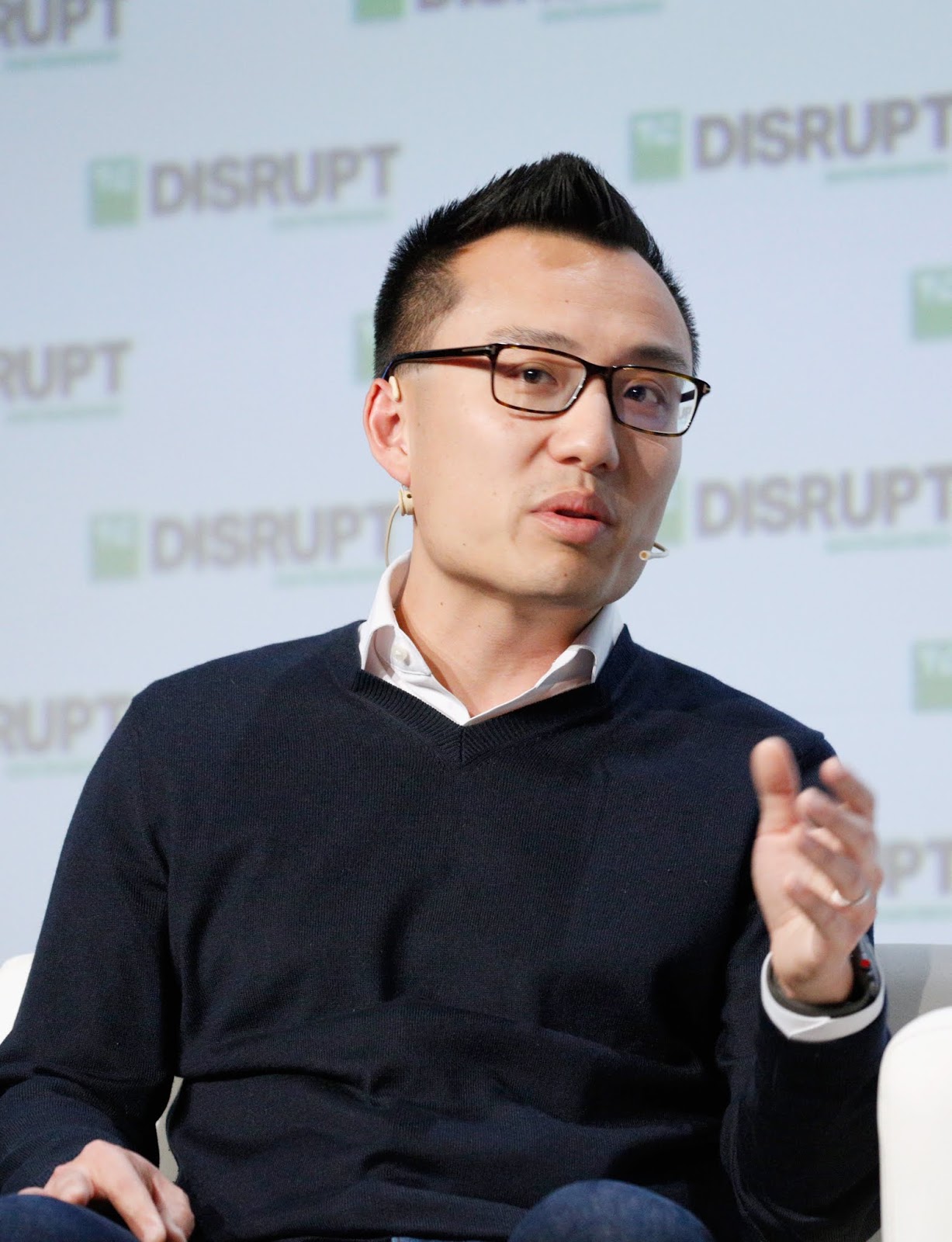

DoorDash CEO Tony Xu. Photo by Kimberly White/Getty Images for TechCrunch, under CC BY 2.0 license. Just a few days…

|

| DoorDash CEO Tony Xu.

Photo by Kimberly White/Getty Images for TechCrunch, under CC BY 2.0 license.

|

Just a few days ago, DoorDash, a well-known food delivery company, filed confidentially to go public. Such confidential filings usually precede a public filing that comes soon after, and then an initial public offering (IPO). A DoorDash IPO has seemed imminent for some time. The San Francisco-based company has already attracted a huge amount of funding ($2.1 billion according to data from Crunchbase), last valued at nearly $13 billion by its investors (its investors include famed VC firms such as DST Global, Coatue Management, Sequoia Capital, and GIC as well as the SoftBank Vision Fund, whose investment strategy has drawn ire and scrutiny as of late amid billions in losses). The Vision Fund’s CEO, Rajeev Misra, has also been accused of running smear campaigns against two top former SoftBank executives in order to forge ahead with his career.

SoftBank was the first investor to spearhead a big investment in DoorDash, having led a $535 million investment in the company in 2018. It’s also participated in subsequent rounds alongside well-known firms like DST Global, Coatue Management, GIC, and Y Combinator. The likes of Khosla Ventures, Kleiner Perkins, Wellcome Trust, and Charles River Ventures are also investors in DoorDash and are definitely eyeing good returns when DoorDash goes public. Firms like Sequoia Capital, Khosla Ventures, and Charles River got into the party early, having invested in DoorDash when the company was dealing with mere millions in funding. For instance, Khosla Ventures and Charles River led $2.4 million in funding for DoorDash in 2013. That amount may have been very significant for DoorDash as at that time, but right now seems like a drop in the bucket for the company. Hell, it’s even less than half of what DoorDash coughed up ($5 million) to settle a class-action lawsuit in 2017.

The early investors surely have their eyes set on drooling returns in the event of a DoorDash IPO. Others like SoftBank, DST Global, and Coatue which arrived the party later will also be looking towards returns although not drooling ones. However, this depends on DoorDash’s performance in the public markets. Earlier in the article, it’s stated that DoorDash was valued at nearly $13 billion — as of its last round — by its investors. To reap, let’s say, a 25% return for any amount invested in DoorDash’s most recent round, the company would have to convince investors and garner enough interest to trade at a market cap hovering around $16 billion on the public markets. Now, convincing investors isn’t really accomplished by words, but mainly by financials. DoorDash would have to prove it’s a sustainable and growing business in order to juice investor sentiment, and as you may or may not know, the food delivery space is one rife with cutthroat competition amongst several companies. This has led companies in the space to wage price wars in order to attract and retain customers and in the process run hefty losses. Running losses means such companies have to keep raising more funding or risk going under, and raising with the hopes that such funding would keep them alive until a moment when they can charge fair prices and run a profitable and sustainable business.

However, the key here is that “moment”, which seems like it’ll never come, or on the other hand may come, but in not-too-soon time.

Now, DoorDash is said to have projected a $450 million loss on revenue of between $900 million – $1 billion in 2019. At the lower end, that would mean losses amounting to 50% of revenue, and 45% of revenue on the higher end. That doesn’t give off signals of a healthy or sustainable business, and DoorDash may have to prepare some good answers to potential investors that’ll raise questions. It may be that they spent so much to expand and win market share (DoorDash expanded to all 50 states in the U.S. last year) or had to lower prices to incentivize customers away from other competing services, who knows?. However, as already said, such financials would likely draw scrutiny and DoorDash better prepare a statistical and well-reasoned answer for its investor roadshow. In a case where they do so? good and in a case where they don’t? hmm, that may not spell well.

For comparison, Postmates, a major DoorDash competitor with whom it once held merger talks with, filed confidentially to go public, just like DoorDash recently did, early last year. However, it hasn’t followed up since then. Under conventional circumstances, a confidential filing precedes a public filing that comes soon after and then a debut on the public markets. However, Postmates was reported to have shopped itself around for an acquisition even after its confidential filing. The company later resorted to more private funding to keep going. Such a resort kind of indicates Postmates wasn’t comfortable in debuting on the public market, or in other words, the more realistic market. Private investors may tolerate running losses in hopes of dominance where there’ll be sustainable cash flow in future time, but in the public markets, you better be ready before you step in. The public market spares no rod, and only rewards those with proven strategies (losses are not the only metric in consideration here, as some companies still run, albeit minor, losses to cater towards expansion and still enjoy good runs on the public market). However, most of such companies are enterprise-facing ones, where prospects are more predictable rather than consumer-facing ones, where prospects are usually unstable.

Having already filed confidentially, a succeeding public filing is expected soon and would give detailed information on DoorDash’s financials. But for now, we can only make do with the little tips of the iceberg spilled around, and judging from them, DoorDash’s financials don’t look so great. We may also remember that tipping controversy that stirred backlash and even a lawsuit from Washington, D.C.’s Attorney General. That doesn’t look great either. How about the recently enacted AB5 ruling by the state of California that DoorDash budgeted $30 million to overturn, may not be great for its bottom line either.

Who knows? DoorDash’s financials could later look promising. It may be that DoorDash’s public filing would indicate substantial year-over-year growth to justify the losses, or who knows? may not and may lead to a disappointing IPO. We can only anticipate if DoorDash’s IPO would be a hit or miss, and we really should.

And for clarity sake, don’t diss Postmates. We have since been gushing over their cute little delivery robot that adopts lidars from Ouster and long-distance human control services from Phantom Auto.