- General

- September 20, 2020

- 5 minutes read

Sequoia Scores Big From IPOs

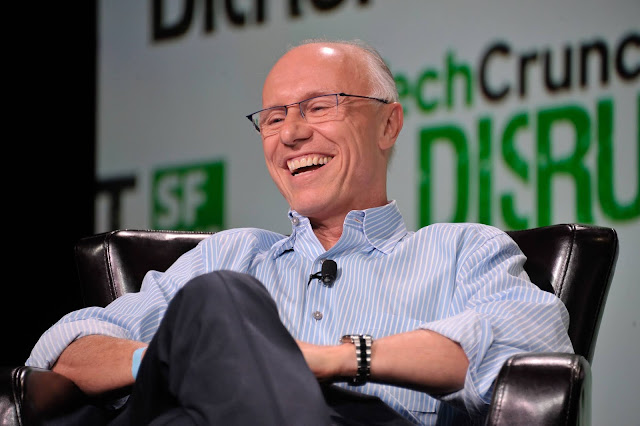

Douglas Leone, Managing Partner, Sequoia Capital. Photo credit: TechCrunch, licensed under Creative Commons Venture capital firm Sequoia Capital is…

|

| Douglas Leone, Managing Partner, Sequoia Capital.

Photo credit: TechCrunch, licensed under Creative Commons

|

Venture capital firm Sequoia Capital is known to be a prolific backer of technology companies globally and has once again proven itself worthy of that status, with billions of dollars in gains from recent initial public offerings of several technology companies. As indicated by public filings, Sequoia currently holds an 8.4% stake in Snowflake, the cloud computing company which recently held the biggest software IPO ever, and a 24.1% stake in Unity, the gaming software company which recently completed a successful public debut. The venture capital firm also holds a stake of less than 5% in Sumo Logic, a data analytics firm that recently raised more than $300 million from a successful public debut. Altogether, Sequoia’s stakes in the three companies sum up to about $9 billion, stakes that were acquired for considerably less than that amount. Sequoia appears to have continued its streak of winning big from the success of technology companies, many of which the venture capital firm invests in their early stages.

Globally, Sequoia is one of the biggest and most storied VC firms, with only a few other venture capital firms to have matched its size and streaks. Although based in and majorly focused on the US, Sequoia has units in India and China, units that each have scored big wins collectively amounting to the tune of billions of dollars. Stretching back to the old days, Sequoia scored big wins by backing then-nascent companies including Apple, Google, Cisco, and Oracle, companies that are today now giants in their own right. Coming forward, the company has scored recent wins on companies including Dropbox, Medallia, Okta, ThousandEyes, Qualtrics, Zoom, and most recently Unity and Snowflake Computing. The company’s wins come from a healthy mix of public listings and big acquisitions.

In future time, we can expect Sequoia to score more of such wins, as the venture capital firm currently holds stakes in some of the highest-valued private technology companies, among them Stripe, Robinhood, UiPath, DoorDash, Graphcore, Glossier, and its likes. Sequoia has an apparent history of scoring significant profit for its investors and could continue that streak again with its most recent fund which was closed just in July of this year. In July, Sequoia raised $1.35 billion to make bets on companies in India and Southeast Asia.

Update: a correction was made to indicate that Sequoia currently holds an 8.4% stake in Snowflake, rather than a previously stated 9%.