- General

- December 1, 2020

- 6 minutes read

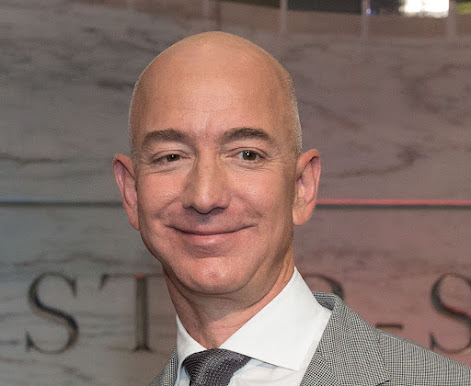

Bezos Stands To Win Big From Airbnb IPO

As the home rentals company Airbnb looks to raise up to $2.6 billion from its imminent public offering and at a…

As the home rentals company Airbnb looks to raise up to $2.6 billion from its imminent public offering and at a targeted valuation of $35 billion, many early investors in the company are set to reap bountiful monetary rewards from their stakes, including the Amazon CEO Jeff Bezos who already holds the title of being the world’s wealthiest individual with a net worth of $186 billion, per Bloomberg rankings.

Bezos notably invested in Airbnb’s $7.2 million Series A round in 2010 and a subsequent $112 million Series B round in 2011. The investment came from his venture firm Bezos Expeditions, which has also invested in lots of other technology companies such as the ride-hailing company Uber, HR software firm Workday, cancer detection startup Grail (recently sold for $8 billion), the indoor farming startup Plenty, and even an Airbnb competitor named Sonder.

The exact size of Bezos’ investment in Airbnb and also if he’s already sold shares of the company in previous secondary rounds isn’t known. Assumedly, he’s likely on the line for a significant monetary reward to add to his mammoth net worth. The imminent win comes just over a year after Bezos was reported to have reaped $400 million from an early $3 million investment in the ride-hailing company Uber when it debuted on the public markets.

Recently, Bezos reaped an assumedly significant monetary reward when one of his portfolio investments, which is the cancer detection startup Grail, sold to Illumina for $8 billion in cash and stock this September. Another of his investments, which is the hyperlocal social networking service Nextdoor is said to be eyeing a soon public offering and could provide yet another dose of profit for Bezos’ large bank vault.

Apparently, Bezos has fared very well on many of his personal investments over the years, cementing his status as a profitable entrepreneur to follow along. Notably, the share price of his e-commerce juggernaut Amazon has risen from $180 at the end of 2010 to $3,168 currently without any dilution, whereas Amazon now has a market value of about $1.6 trillion and has delivered lucrative profits for many of its investors over the years.

Photo: Amazon CEO Jeff Bezos|by national museum of american history, licensed under CC BY-NC 2.0