- GeneralM&A

- October 21, 2021

- 6 minutes read

Deal: Blackstone Buys Majority Stake In Spanx, At $1.2B Value

Blackstone (NYSE: BX), a private equity giant, is buying a majority stake in Spanx, the famous shapewear brand founded by female…

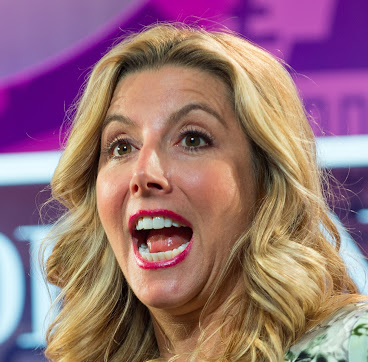

Blackstone (NYSE: BX), a private equity giant, is buying a majority stake in Spanx, the famous shapewear brand founded by female entrepreneur Sara Blakely. The deal values the brand at $1.2bn.

- Blackstone is buying a majority stake, meaning over 50%, but the exact percentage it’s buying isn’t disclosed. Meanwhile, founder Sara Blakely will continue to hold a “significant” minority stake in Spanx, the company said.

- Spanx is a major success story, the type that vaulted Sara Blakely into the ranks of America’s best-known female entrepreneurs. As the story goes, she founded the brand in 2000 with an initial investment of $5,000, an investment that has multiplied dramatically. Blakely owned 100% of the brand since inception until now that she’s selling to Blackstone for a lucrative sum.

- Under Blackstone’s ownership, Spanx will continue to target high business growth, with Blakely at the helm as Executive Chairwoman. It’s a usual occurrence with private equity deals where companies are bought and steered by their founders who maintain skin in the game with a minority stake, hoping to sell for a higher amount in the future.

- As a privately-held company, Spanx doesn’t release official revenue figures, but a New York Times report says the company made sales between $300mn to $400mn in 2020. That’ll imply a 3x-4x valuation multiple Blackstone is paying, a typical amount for deals of this sort.

- This is Blackstone’s second big acquisition of a female-led company in the past few months. In August, through a subsidiary, the private equity firm bought the production company of Hollywood star Reese Witherspoon in a $900mn deal.