- General

- November 13, 2020

- 5 minutes read

DoorDash Files To Go Public

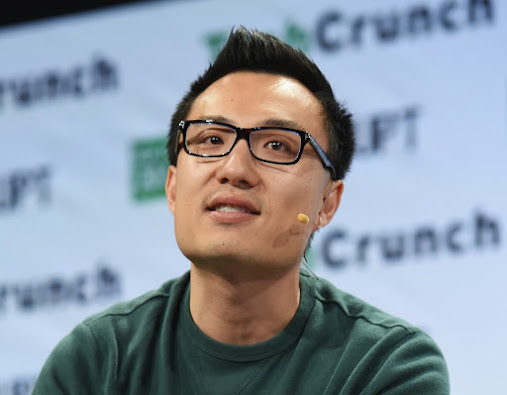

DoorDash CEO Tony Xu.Photo credit: TechCrunch, licensed under CC BY 2.0 After submitting a confidential draft registration to go public in…

|

| DoorDash CEO Tony Xu. Photo credit: TechCrunch, licensed under CC BY 2.0 |

After submitting a confidential draft registration to go public in February, food delivery company DoorDash has now publicly submitted a filing to go public with the U.S. Securities and Exchanges Commission, listing a placeholder amount of $100 million that’s, however, subject to change.

DoorDash is looking to go public seven years after its founding and with $2.5 billion in private funding raised along the way. The company’s most recent private funding round placed its valuation at $16 billion.

DoorDash’s S-1 filing indicates $1.9 billion in revenue in the nine months leading to September 2020, more than triple the $587 million it pulled in for the same period last year. The exceptional revenue growth isn’t surprising, given the coronavirus pandemic widely boosted the need for on-demand food deliveries across the US.

With $1.9 billion in revenue, DoorDash lost $149 million in the nine months leading up to September. In the whole of 2019, the company pulled in $885 million in revenue and reported a net loss of $667 million in the same year. As shown, a business boost amid the coronavirus pandemic has reduced DoorDash’s losses by a very significant margin.

DoorDash has submitted its filing to go public just on the heels of an apparent win after the US state of California voted in favor of a ballot that upheld the status of app-based delivery drivers and gig workers used by firms like DoorDash as independent contractors rather than employees. DoorDash was part of a group of on-demand companies that poured in over $205 million to support the ballot and created what counts as the most expensive ballot ever in California’s history.

DoorDash’s IPO is being underwritten by a group of investment banks including Goldman Sachs, J.P. Morgan, Barclays, UBS, and Deutsche Bank Securities. The company is said to be looking to go public before the end of this year.