- General

- October 24, 2020

- 4 minutes read

Paul Tudor Jones Hypes Bitcoin

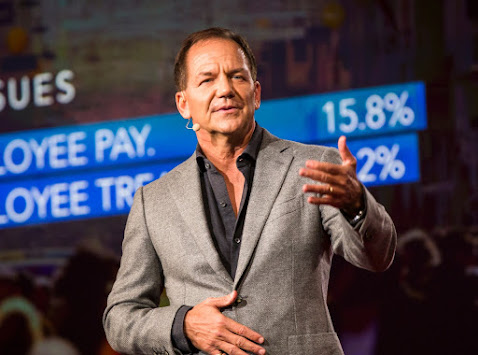

Paul Tudor Jones, Founder, Tudor Investment Corporation. Photo credit: Ryan Lash / TED, licensed under Creative Commons Paul Tudor Jones,…

|

| Paul Tudor Jones, Founder, Tudor Investment Corporation.

Photo credit: Ryan Lash / TED, licensed under Creative Commons

|

Paul Tudor Jones, a famed American hedge fund manager and billionaire, has continued his streak of touting cryptocurrency, this time even more bullish by calling bitcoin the best inflation hedge. In an interview with CNBC, he compared investing in bitcoin to “investing with Steve Jobs and Apple or investing in Google early” and that the cryptocurrency “has this enormous contingence of really, really smart and sophisticated people who believe in it.”

Jones’ comments come just on the heels of bitcoin reaching a price of nearly $13,000, its highest level since January 2018. Jones is actually not new to backing bitcoin and had earlier this month revealed bitcoin holdings in his investment portfolio. He’s among a cohort of established investors and firms who have recently touted bitcoin and even bought significant amounts of the cryptocurrency. Among such firms include business intelligence company MicroStrategy, which recently purchased over $400 million worth of bitcoin as a value hold, and payments company Square, which recently purchased $50 million worth of bitcoin.

MicroStrategy and Square are big companies and more so publicly-traded ones. They seem to be testing the waters for publicly-traded companies adopting the use of bitcoin as a value-hold and could pave the way for other big firms to jump in.

Paul Tudor Jones of this case is a hedge fund manager that shot to fame after he predicted and profited big from the 1987 stock-market crash. In 1987, Jones’ eponymous investment firm, Tudor Investment Corporation, anticipated a US stock market crash and reaped substantial profit thanks to large short positions. That year, Tudor returned over 120% net of fees and earned an estimated $100 million.

These days, in addition to being a hedge fund manager, Jones is a noted conservationist and philanthropist who’s also well-known for co-founding the popular Robin Hood Foundation in New York City.