- FintechGeneralSPAC

- June 7, 2021

- 5 minutes read

SPAC: Banking App Dave To Go Public In $4B Deal

In the world of special-purpose acquisition companies, there are new mergers unveiled every day. This day, the new merger on…

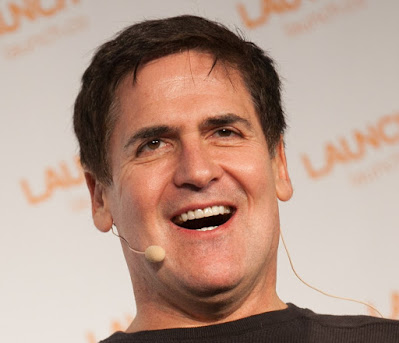

In the world of special-purpose acquisition companies, there are new mergers unveiled every day. This day, the new merger on the block is Dave, a banking app backed by investors including Mark Cuban.

- Dave has agreed to merge with VPC Impact Acquisition Holdings III, Inc. (NYSE: VPCC) and become a public company. That’s the SPAC sponsored by Victory Park Capital, an investor in Dave before now.

- The deal terms of Dave’s merger value the banking startup at $4bn. The merger will see Dave get $254mn of cash held in trust by the VPC SPAC and then a $210mn PIPE round led by hedge fund Tiger Global.

- As usual for SPAC deals, Dave’s merger announcement came packaged with an investor presentation that provides strong insight into its business. It shows that the banking app, with 10 million users, made $122mn in revenue in 2020.

- Impressively, Dave was founded just four years ago and is now set for a $4bn exit on the public markets. Not many startups can boast of that growth and success in a short period of time.

- Compared to rival neobanks of its kind, Dave has raised a small amount of equity funding – $61mn. Its investors include tech billionaire Mark Cuban, seed fund SV Angel, and banking giant Capital One.

- Following the completion of its merger, Dave will start trading on the New York Stock Exchange under the “DAVE” trading symbol.

Photo: Mark Cuban, credit: jdlasica, licensed under CC BY 2.0