- General

- November 16, 2020

- 5 minutes read

Amazon Doubles Down On South Korea

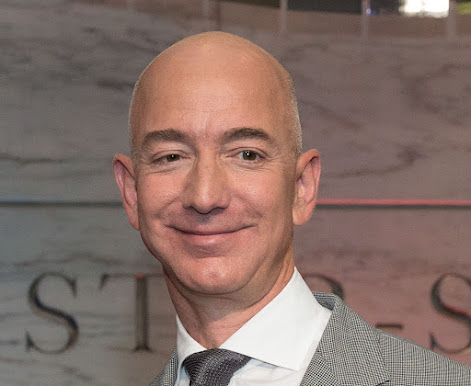

Amazon CEO Jeff Bezos. Photo credit: national museum of american history, licensed under CC BY-NC 2.0 Amazon, the American e-commerce giant, is…

|

| Amazon CEO Jeff Bezos. Photo credit: national museum of american history, licensed under CC BY-NC 2.0 |

Amazon, the American e-commerce giant, is expanding its horizon in South Korea by entering into a partnership with SK Telecom, the country’s largest wireless carrier, that’ll see it sell its products on SK’s e-commerce subsidiary 11st. Under the terms of their partnership, Amazon has secured rights to acquire a minority interest in 11st if certain conditions are met, with local reports that the e-commerce giant plans to pony up $300 million for a stake in 11st.

Amazon’s South Korea move furthermore indicates the company’s commitment to significant international expansion. This year alone, Amazon has launched new standalone marketplaces in Sweden, Saudi Arabia, and The Netherlands. The company also committed to invest an extra $1 billion in its operations in India after having previously spent $7 billion in the country.

In its most recent quarterly earnings results which is for the third quarter of this year, Amazon reported a 37% year-over-year sales growth in international markets outside North America. The company’s international business currently spans 17 marketplaces across the globe and before this year had reported slower growth rates. With a recent Covid-19 pandemic that’s fueled a big shift towards online shopping, it’s no surprise that Amazon’s international markets have kicked back to high growth rates.

Amazon will work together with SK Telecom’s 11st to boost its business in South Korea. As expected, the use of local partners does a lot of good for foreign companies looking to do business in countries outside their usual terrain. The reported $300 million that Amazon plans to invest in 11st seems big but overall is a minor investment for a company that reported having about $68 billion in cash and marketable securities on its balance sheet as of the end of September this year.