- General

- April 8, 2021

- 7 minutes read

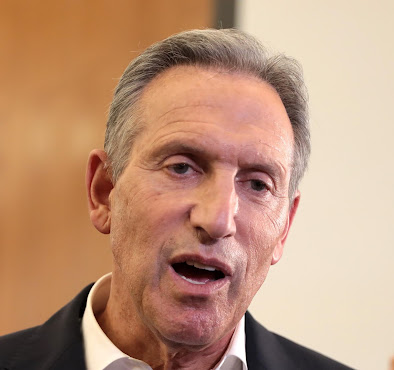

Ex Starbucks Boss Howard Schultz Invests In Cybersecurity Startup Wiz

Howard Schultz, the former chairman and chief executive officer of coffee chain giant Starbucks, has put a small part of his…

Howard Schultz, the former chairman and chief executive officer of coffee chain giant Starbucks, has put a small part of his $5 billion+ fortune to buy a stake in a hot cybersecurity startup named Wiz.

Wiz is a cloud security startup founded by serial entrepreneurs that sold their previous cybersecurity startup named Adallom to Microsoft for a reported $320 million. Just a year-old, Wiz recently closed a $130 million funding round valuing it at $1.7 billion, a round that Howard Schultz participated in according to Bloomberg.

- Schultz’s participation in Wiz’s recent funding round wasn’t reported before. He joined others like Sequoia Capital, Insight Partners, and Greenoaks Capital in the round.

- Schultz has previously invested in other startups like Swedish plant-based milk maker Oatly and mental health care provider Lyra Health. With a fortune of over $5 billion, he can very much afford to invest in many startups without even worrying about recouping his investments.

- Wiz helps clients like United Airlines and The Home Depot to seek for potential risks in their cloud systems and act upon them if discovered. It’s based in Israel.

- With a $1.7 billion valuation after just a year of existence, Wiz is one of the fastest-growing cybersecurity startups in history.

- Howard Schultz built a fortune by growing Starbucks from a small coffee chain into a global powerhouse. He served as the company’s chairman and CEO from 1986 to 2000, and then again from 2008 to 2017.

Photo credit: Gage Skidmore, licensed under CC BY-SA 2.0

More news bits;

- After a botched $5.3 billion sale to Visa, fintech startup Plaid emerged to raise a $425 million round valuing it at over $13 billion. With that, a botched $5.3 billion sale doesn’t look so bad anymore.

- LumiraDx, a UK-based diagnostics startup that capitalized on the pandemic by producing Covid-19 test kits, has sealed a deal to go public by merging with a special-purpose acquisition company. It’ll merge with CA Healthcare Acquisition Corp (Nasdaq: CAHC) in a deal valuing it at $5 billion.

- Courier giant United Parcel Service (UPS) has its eyes set on a future where it’ll make use of electric vertical takeoff and landing (eVTOL) aircraft to ferry goods. It’s acquired options to purchase up to 150 eVTOLs from Vermont-based startup Beta Technologies. 10 of those eVTOLs are expected to be delivered in 2024.