- General

- November 9, 2020

- 5 minutes read

SoftBank Makes Bank On KE Holdings

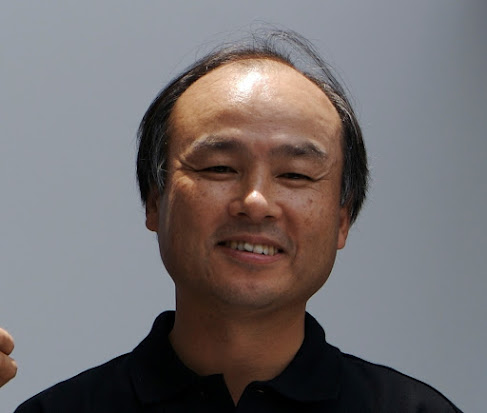

Masayoshi Son, CEO, SoftBank.Photo credit: Masaru Kamikura from Japan, licensed under CC BY 2.0 Japanese tech conglomerate SoftBank has reaped big profits…

|

| Masayoshi Son, CEO, SoftBank. Photo credit: Masaru Kamikura from Japan, licensed under CC BY 2.0 |

Japanese tech conglomerate SoftBank has reaped big profits from one of its less-popular bets, the Chinese real estate company KE Holdings which went public in August this year. SoftBank invested $1.35 billion last November into KE Holdings, also known as Beike, and has seen the value of its stake soar to about $6.4 billion as KE Holdings has surged 375% from its IPO price. It represents one of SoftBank’s most recent successful investments at a time when it’s grappled with heavy losses from soured bets such as WeWork.

As of late, SoftBank has put money into several American tech giants and could clinch significant gains from them. The Japanese conglomerate is projected to report $1.4 billion of net income for the third quarter of this year, compared to a loss of 700 billion yen ($6.8 billion) in the same quarter last year.

KE Holdings, now one of SoftBank’s most successful bets, is a Chinese real estate brokerage platform. It’s the Chinese equivalent of America’s Zillow Group and is the biggest real estate brokerage platform in the country. KE raised $2.1 billion in its IPO in August by selling 106 million American Depositary Shares for $20 each. The company’s share price has since soared to nearly $76, giving it a market value of $85.2 billion.

Before going public, KE was heavily funded by investors including SoftBank, Tencent, Sequoia Capital China, and Hillhouse Capital Group. The company raised the equivalent of $3.6 billion in private funding before debuting on the public markets.

SoftBank is set to report its quarterly earnings results on Monday, the 9th of November and will likely highlight winning investments such as Beike to its shareholders.