- General

- October 11, 2021

- 7 minutes read

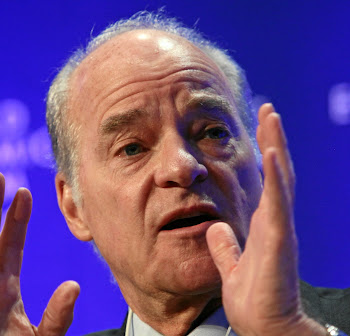

At KKR, Historic Private Equity Barons Step Down

Two of the godfathers of modern-day private equity investing, Henry Kravis and George Roberts of the famous leveraged buyout firm KKR (NYSE:…

Two of the godfathers of modern-day private equity investing, Henry Kravis and George Roberts of the famous leveraged buyout firm KKR (NYSE: KKR), have handed in the reins by stepping down as Co-CEOs from their firm. Replacements have been named for them, effectively.

- Henry Kravis and George Roberts, together with the late Jerome Kohlberg, pioneered America’s industry of “leveraged buyouts (LBO)” where Wall Street firms bought companies using borrowed money, with the companies themselves used as collateral for debt and their future profits used to pay it down.

- LBOs built a reputation as a form of “ruthless” capitalism that continues to this day, because of some strong-arming tactics by which Wall Street firms chased after them. This tainted reputation made LBO firms rebrand to what we currently call private equity firms.

- At KKR, Kravis and Roberts’ landmark deal was acquiring RJR Nabisco, a tobacco and food giant, for $25bn, mostly borrowed money, in 1988. The deal resulted in major losses for KKR but not enough to cause a storm. A famous book was written about the ordeal, titled Barbarians at The Gate.

- KKR has been removed from the cohort of old-guard big buyout firms still led by their founding leaders. Among the few now left include Blackstone, the world’s biggest buyout firm by assets under management, still led by co-founder Steve Schwarzman.

- The trend of old-guard leaders handing the leadership reins at their firms isn’t unexpected. Buyout kings like Kravis, Roberts and their peers are nearing their 80s, a ripe age for retirement with the billions or hundreds of millions they have made.

- For the private equity industry, Kravis and Roberts stepping down as Co-CEOs is marking the end of an era. The mark will be solidified when Steve Schwarzman of Blackstone decides to hand in the reins, and that’s not unexpected for someone who’s currently 74 years old.